South Africa | Forex Licensing

How to get an FSCA license for your firm

As forex regulations in Europe have tightened, many brokers have started moving their firms to countries outside the EU or setting up divisions of their brokerages in non-European countries.

Although island nations in the Pacific and the Caribbean get a lot of attention when it comes to moving offshore, South Africa is quickly becoming a popular choice for both existing brokers and new brokers.

The restrictions on leverage and bonuses have made it difficult for many firms to attract new clients. Licensing also presents barriers for new firms. Regulatory agencies often require brokerages to keep significant capital on hand.

For instance, the Financial Conduct Authority in the United Kingdom requires brokers have £1,000,000 in operating capital. These requirements and restrictions mean brokers often have a stronger business with more clients when they are unlicensed. However, some clients aren’t comfortable working with an unlicensed firm.

South Africa’s regulatory framework presents a beneficial opportunity for brokers who wish to be licensed but also want to give clients the leverage and bonuses they’re seeking. We’ve been hearing from a lot of IBs interested in starting their own firms in the nation, and this post offers insights into the process of becoming licensed to sell forex products in South Africa.

Basic regulations

To offer investment products and advice you must be a financial service provider (FSP) licensed through South Africa’s regulatory body, the Financial Sector Conduct Authority (FSCA). Forex brokers typically need to be a Category I FSP.

Once licensed, you can offer accounts with high leverage and bonuses in South Africa. The FSCA doesn’t have a set minimum capital requirement. Instead, brokers are required to retain capital to cover all of their liabilities and operating expenses. You also need to have professional indemnity insurance.

You must also have one director with South African residency and a bank account with a bank in South Africa.

Regulatory exams

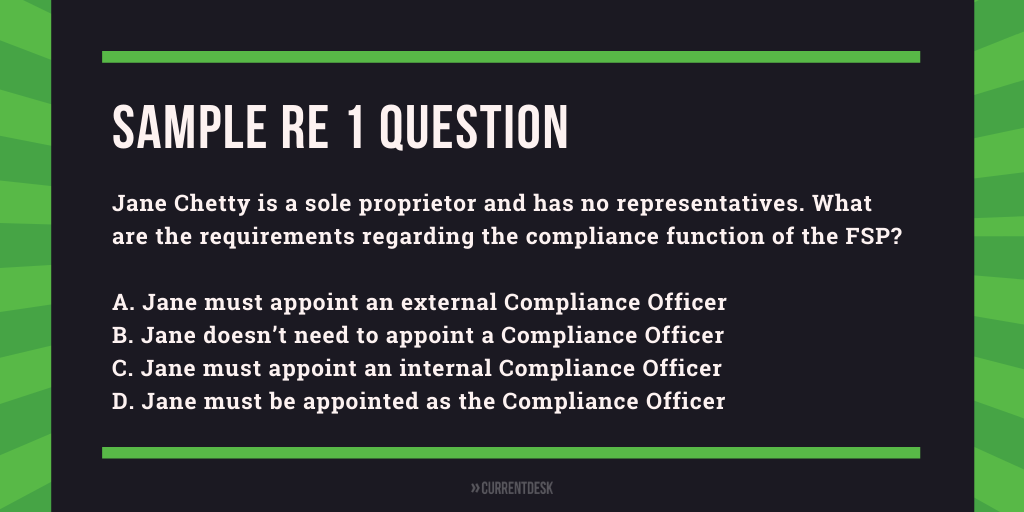

To become an FSP who can sell forex products, you must pass two exams — the FSCA’s Regulatory Exam 1 (RE 1) and Regulatory Exam 5 (RE 5).

The RE 1 consists of 80 questions, and you need at least 65% on the exam to pass. The questions aren’t weighted, so you have to answer 52 questions correctly to pass. You’ll be given 2 ½ hours to take the test. The RE 5 only has 50 questions, and you have to answer 33 questions correctly to pass. Since the exam has fewer questions, you’re given less time. You’re allowed 2 hours for the RE 5.

All of the questions on these exams are multiple choice, and the questions are based on the information in four types of legislation and financial regulations:

- The FAIS Act as amended by the Financial Services Laws General Amendment Act 45 of 2013

- FSCA General Code of Conduct for authorized Financial Services Providers

- FIC Act (FICA)

- FSCA Board notices

Currently, Moonstone is the only organization that administers these tests. To take the tests and begin the licensing process, you must register for the exam on the Moonstone website. Moonstone’s website has a Preparation Guide for Regulatory Exams that can help you prepare for the test and learn more about them. It costs R 1,226 to take each exam in South Africa. If you take the exam in another country, the fee is £210.

Fit and proper qualification

In addition to passing the RE 1 and RE 5, you must also meet the FSCA’s definition of being fit and proper. Demonstrating that you’re fit and proper will likely be the most tedious and time-consuming part of the application process, because it takes a great deal of documentation.

You can review Board Notice 194 of 2017 to see a full list of fit and proper requirements. The various requirements fall into five broad categories.

- Honest, integrity, and good standing: This category addresses whether you’ve been convicted of crimes like fraud, theft, or forgery, or if you’ve been sanctioned by the FSCA or a similar regulatory authority.

- Competence: This category relates to whether you have the necessary knowledge to offer advice about investment products. It covers your education and experience with financial products. This category includes passing the RE 1 and RE 5.

- Continuous professional development: This category details the actions an FSP will need to take to maintain their knowledge of financial products and investment advice.

- Operational ability: This category includes the requirements you need to effectively offer services to clients, mitigate risk, and keep records. It covers things like having a business address, a disaster recovery plan, and compliance procedures.

- Financial soundness: This category relates to your working capital and liquidity.

Fees

You will need to pay several fees for when you apply to be a licensed FSP.

If you’ll be working as a sole proprietor, you will pay R 2,544 for the application for authorization as a Category I FSP, and another R 2,568 to have your credentials and qualifications recognized. There are additional fees if your firm has other employees.

After your firm is established, the fees required for regulation are based on the size of your firm and your profits.

Forex licenses can help you attract clients and add credibility to your marketing activities. If you choose to pursue a license in South Africa, you can complete the process on your own. You can also hire a firm to help you. There are law firms that offer assistance with licensing and Moonstone also offers licensing services.

You should always speak to a legal advisor before making decisions about regulations. Our blog posts should not be considered legal advice.

Comments are closed.