Forex Traders and Costs [Infographic]

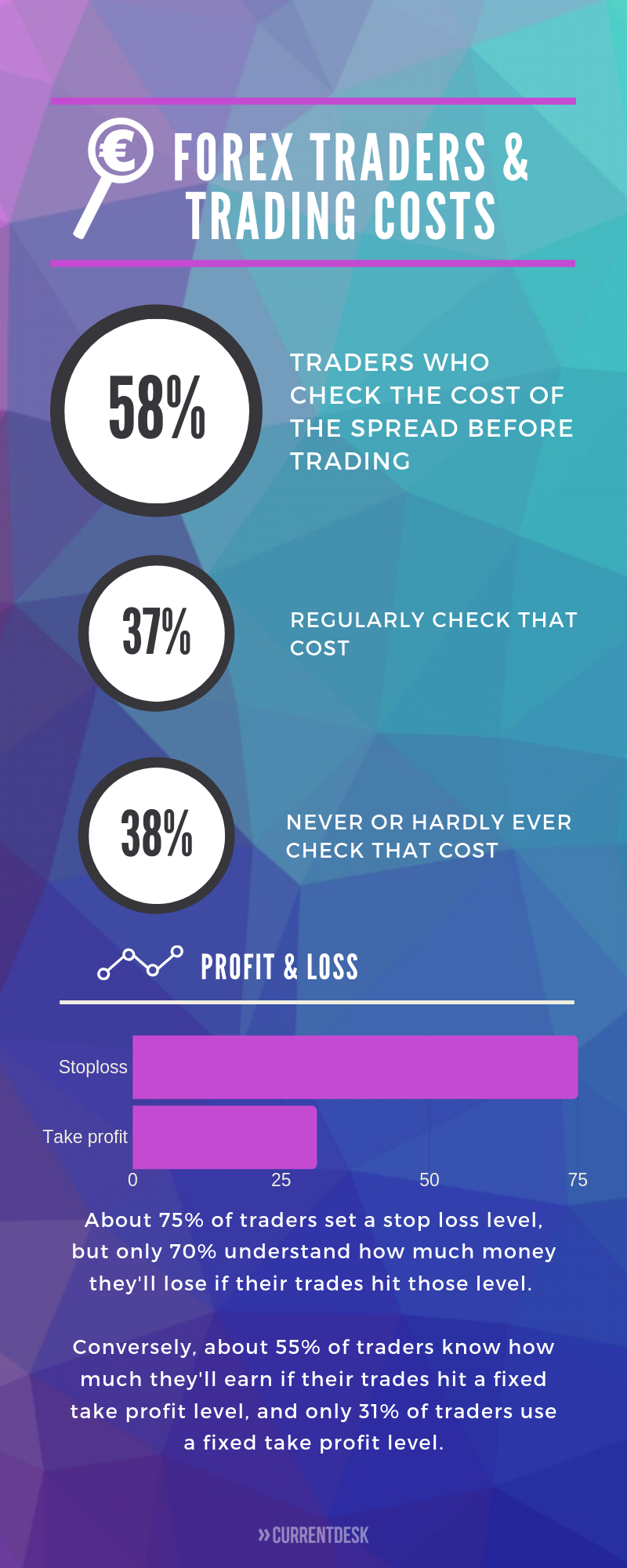

Do forex traders care about spread costs?

The cost of complying with regulations or moving off-shore continue to shrink profit margins for retail forex brokers. Spread markups are one of the ways that your firm may make a profit from offering services to traders.

Low spread markups may be a way to attract new clients, but reducing spreads also reduces your profits.

We’ve looked at research on forex traders in several recent posts, and in this week’s post we’re sharing info about how aware traders are of the costs of trading.

This research comes from data collected from November 2015 to April 2016 and published as Retail FX Trader: Survey Results.

According to this research, the majority of traders do not check the cost of a spread every time they trade. This might indicate that low spreads are more important for attracting leads than they are for retaining your existing traders.

The data also shows that many traders don’t have a good grasp of how much money they could win or lose on their trades. It’s unclear why traders don’t understand the profits or losses that could result from their trades.

All of this information can help you run your brokerage. You may be able to adjust spreads to increase profits, or you could encourage traders to be more active by making stop losses easier to understand.

Forex back office platform for brokers

Automate manual processes and level-up your broker operations

Comments are closed.