How to start a forex brokerage in Africa

What you need to know about growing your forex business in Africa

Developing in new regions to expand your client base is a smart way to grow your forex brokerage and protect your firm from losses due to new regulations in Europe. We recently covered the possibility of moving your brokerage into the Middle East and North Africa. However, the majority of the African continent isn’t included in that region.

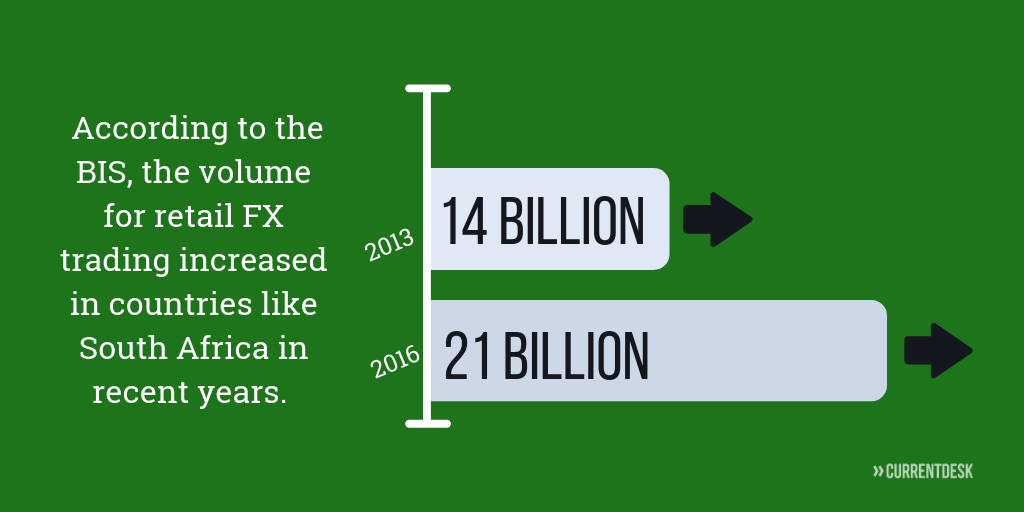

In recent years, the demand for retail FX trading in Africa has been expanding. For example, between 2013 and 2016 the volume of retail forex trading in South Africa grew from $14 billion to $21 billion, according to the Bank of International Settlements.

In recent years, the demand for retail FX trading in Africa has been expanding. For example, between 2013 and 2016 the volume of retail forex trading in South Africa grew from $14 billion to $21 billion, according to the Bank of International Settlements.

This post addresses the forex market in Africa, and what you need to know if you want to open a new brokerage there or expand your existing business into the region.

Currency and PSP considerations

Africa has 54 countries with 45 unique currencies. This diversity means that payment processing can be somewhat complex. If you plan to market to clients in multiple countries, you may need to work with multiple payment service providers (PSPs).

DPO, Cellulant, and WireCard (formerly MyGate) are three PSPs in Africa. DPO is one of the biggest PSPs in Africa, and it continues to grow by acquiring smaller PSPs. It has offices throughout Africa as well as one in Ireland. Cellulant is working to establish financial options for the unbanked by setting up agent locations throughout the continent. If you plan to target traders in more rural areas, it might be a good choice. WireCard is a larger company with a bigger presence outside Africa. However, it doesn’t accept clients from as many African countries as the previous two options.

Each of these PSPs should allow you to integrate your payment process with the forex back office software you choose, as long as the software is capable of integrating with PSPs.

Licensing and regulation

Africa has significantly fewer regulatory options than countries in the European Union. Many brokers actually open offices in Africa because it allows them to operate without the regulations suggested by ESMA.

You can operate in Africa without a license from a regulatory agency on the continent. If you choose to operate without a license, you may need to take extra steps to show clients that your firm is reputable and can be trusted with their investments. You should also discuss your plan to operate without a license with an attorney.

That said, having a license from a regulatory authority helps you attract clients that want to know their investment firm has some oversight. If you want a license in Africa, you can obtain one through the Financial Sector Conduct Authority (FSCA) in South Africa or the Securities and Exchange Commission (SEC) of Nigeria.

Of the two options, the FSCA is the more popular option. The forex market is popular in South Africa, and the country makes an excellent base of operations to work with introducing brokers (IBs) in other African countries. You can find a great deal of information about licensing for forex brokerages on the FSCA’s website.

Marketing your Forex brokerage in Africa

Marketing in Africa doesn’t need to vary much from marketing in other regions. You can use social media marketing to attract leads and increase brand awareness. Facebook is the most popular social media site on the continent. About 64% of social media activity in Africa happens on the Facebook platform, and there are about 16 million Facebook users in South Africa alone. You can use Facebook ads to attract leads and post to your Facebook page to highlight your services.

YouTube is also quite popular in Africa. It would be an ideal platform for sharing educational videos about forex trading. That kind of online activity can help you show leads that you understand forex trading and want them to succeed.

YouTube is also quite popular in Africa. It would be an ideal platform for sharing educational videos about forex trading. That kind of online activity can help you show leads that you understand forex trading and want them to succeed.

Google is the most popular search engine in Africa, so you should try to optimize your firm’s website so Google shows it to searchers. Google provides several free tools to help with SEO. SEO and social media marketing are especially important because Google Ads does not allow forex advertising in any African country, even if you have a license.

Forex Brokerage software tools

You can use any forex software for your brokerage in Africa. However, there are a few things to look for that will make it easier to run your firm there.

API for PSPs:

Depending on which markets you plan to target, you might need PSPs that automatically integrate with the back office software. Look for forex software that has an application program interface (API) that will allow your firm to connect with any PSP you want.

Multi-level partnership management:

IBs are popular in Africa, and working with these partners will help you expand more quickly. To attract and keep good IBs, you need software that lets you easily pay them the right commissions and fees. Look for a forex CRM that will help you do so.

Email marketing tools:

Because you can’t use Google Ads in Africa, you need to have great tools for other kinds of marketing. Look for a forex CRM that includes an email feature so you can directly email leads and automatically generate lists of clients who meet specific criteria.

Expanding into a new region always presents challenges. However, the right knowledge and tools, can make it much easier. Once you have the right software and partnerships in place, finding new forex clients in Africa won’t be that different from any other market.

You should always speak to a legal advisor before making decisions about regulations. Our blog posts should not be considered legal advice.

Comments are closed.