Guide to Forex Back Office Software

What to look for in forex back office software solutions

Back office forex software needs to make it easier for you to run your brokerage. That means it should increase productivity and streamline complex processes.

Forex software providers will all tell you that they have everything you need. Before you sign-up for their services, you need to make sure they’re really offering comprehensive back-office functionality.

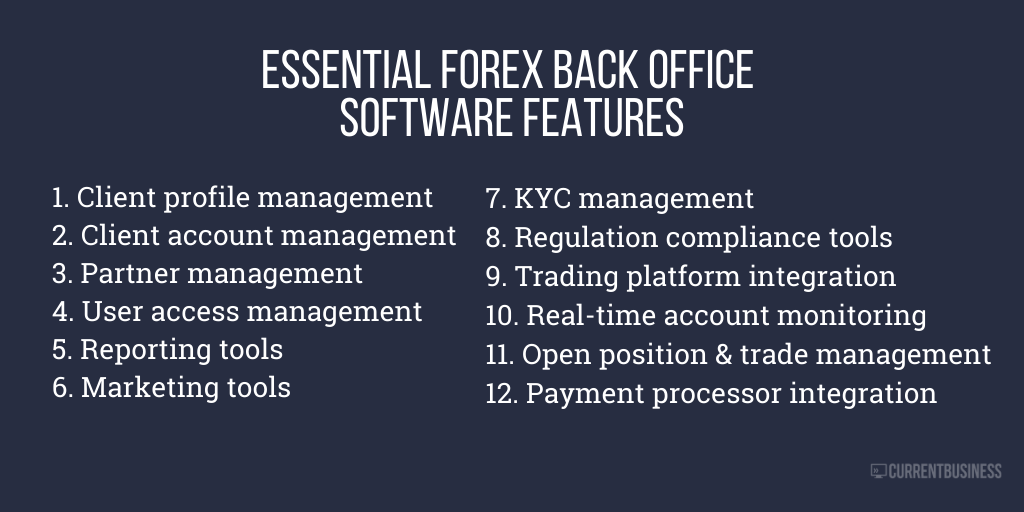

Modern Forex back office software should have these 12 features:

- Client profile management

- Client financial account management

- Partner and IB management

- User access management

- Reporting tools

- Marketing tools

- KYC management

- Regulation compliance tools

- Trading platform integration

- Real-time account monitoring

- Open position and trade management

- Payment processor integration

Client profile management

Back office forex software should make it easy to store and maintain clients’ information and personal data. You should be able to create a new client profile quickly and make updates to it without much hassle. The interface should make it easy for you to see details about clients’ experience levels, residency, and other information that can help you recommend the right products for them while remaining compliant with regulations and laws.

Client financial account management

In addition to viewing general information for clients, you also need to be able to view and manage the balances in their accounts. Back office software should allow you to track the balances of all client accounts within your financial organization. It should also let you transfer funds between multi-currency accounts for clients, add credits and rebates to clients’ accounts, and issue refunds to clients. Monitoring and managing account balances will ensure that you can help clients who have questions about their balances.

Partner and IB management

If your forex firm works with introducing brokers (IBs), then your back office software needs to allow you to calculate and pay partners commissions and rebates. It should also include partner tools so that IBs can help their own clients. Allowing partners to directly access your software will make it easier for them to do their jobs, and using the software to ensure they’re paid the correct amount will help you retain good IBs.

User access management

Back office forex software must include the ability to manage which actions different users can perform. Although you should have the ability to transfer funds for a client, not all administrators and partners need that ability for every client. To minimize the risk of accidental activity and to protect your clients’ data, managing user permissions is essential. Before purchasing any back-office tool, ask about permissions and settings around user roles.

Reporting tools

Back office software for forex brokers should have simple reporting tools so that you can access data about the actions of clients, partners, and other administrators. The software should let you generate reports around trading activity, earnings and losses, deposit amounts, and CDF dividends. Those reports can help you determine how to best market to and re-engage existing clients. The software should also record all the activities of partners and other administrative users so that you can track their work.

Forex Marketing tools

Back office forex software should include marketing tools that you and your IBs can both use. With the data from your reports, you should be able to see which clients are actively making trades and which ones have reduced their trading activity. The software should then allow you to create groups of clients to target with emails so you can direct marketing activity to the right clients. It should also allow you to create exclusive promotion links that you or your partners can share so that you can track the source of new leads.

KYC management

Know Your Client (KYC) rules help prevent money laundering and are the most common regulations put in place by governmental financial authorities. Your forex firm’s back office software needs to include a KYC module for enforcing compliance procedures. It should let you upload and store documents to confirm clients’ identities. Look for software that lets you specify an expiration date so you know when new documentation is needed.

Regulation compliance management

Although KYC requirements may be the most common regulatory rule, there are many others that your firm must fulfill if you are licensed with a regulatory authority like FCA, ESMA, and CySEC. Forex back office software is an excellent solution to the challenges or regulatory requirements. The reports and records the software can produce make it much easier to show regulators how your firm operates and to obtain the data you’ll need for licensing.

Trading platform integrations

Forex brokerage back office software can work independently of the trading platform your firm uses. However, your brokerage’s operations will be much more smooth if the back office software integrates with MT4, MT5, or the platform of your choice. Your back office software should let you create trading account groups that connect to the trading platform. This connection will enable you to establish fees, commissions, and rebates within your software so that reports and payments are more accurate.

Real-time account monitoring

If your back office software integrates with your forex trading platform, you can have real-time monitoring of all accounts. You’ll be able to view real-time margin, P/L, and position sizes for all client orders. This information will ensure you can issue margin calls at the appropriate times and advise your clients of their risks. It will also allow your firm to control its exposure, which might be especially useful if part of your firm operates as a dealing desk brokerage.

Open position and trade management

When your forex back office software connects to your trading platform with real-time monitoring, you’ll be able to open and close trades for clients. Your software will make it easy to set stopout levels and automatically implement them to reduce a client’s risk.

Payment processor integration

One of the most significant barriers to clients depositing money is a complicated or lengthy process for funding their accounts. Connecting your back office software to external payment systems (like credit card processors, crypto-currency wallets, and bank transfers) reduces the length of time it takes for deposits to be credited to client accounts. Look for a tool that can integrate with Skrill, SafeCharge, or NETELLER.

Final thoughts

New Forex back office software requires two kinds of investments: money to purchase the software and time to implement it. Before making those investments, make sure the software you’re purchasing is worth it.

To do that, consider where you want your firm to be in a few years. You may not have partners now, but if you want your firm to grow then the back office tools you choose should include features for managing IBs or money managers. Similarly, you may not plan to seek regulatory licensing immediately, but doing so in the future could help you expand your business into new regions.

Purchasing the right back office platform helps future proof your brokerage. CurrentDesk supports hundreds of the world’s leading Forex brokers. Contact us if you’d like to learn more.

Looking for more tips on growing your brokerage?

Check out our brokerage marketing guide below.

Comments are closed.