How to Track Forex Advertising ROI and Lead Generation

Effective marketing of your FX Brokerage is a vital element to your revenue. It requires a substantial investment that needs to be deployed wisely. So, how can you measure the effectiveness of your Forex marketing strategy or gauge where it can be improved?

The answer is simple. Measure your campaign marketing ROI (Return on investment).

The quickest way to calculate ROI?

The most straightforward formula to calculate ROI is:

(Amount gained – Amount Invested) / Amount Invested = X

That means for every 1 unit of currency invested; you get X in return.

For Forex marketing campaign tracking, we suggest going into more detail as you’ll want to be able to track more elements than just revenue. This means you can play around with the levers that would impact your ROI and stress test possible outcomes. To do this, you’ll need some of your sales funnel metrics that you can find in your Forex CRM.

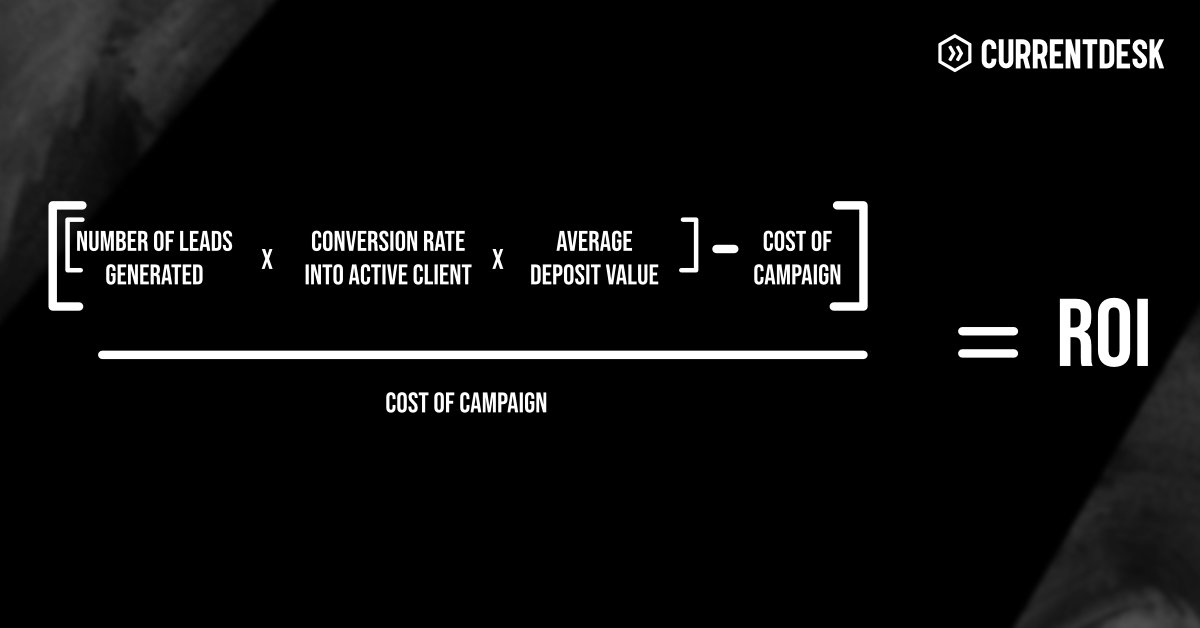

So, to start, pick a date range for a specific campaign and try using this formula to check the ROI of a specific campaign against some others:

[(Number of leads generated * conversion rate into active client * average deposit value) – Cost of campaign] / Cost of campaign

Let’s explain the data points further to ensure that the formula is easy to use.

Number of leads – The number of people who registered for a trading account from a specific campaign link but have not yet converted into an active client within the time frame selected.

Lead to active client conversion rate – The percentage of leads who turned into clients and made a successful first deposit within the time frame. (Not all leads are going to convert into active clients. A high conversion rate shows you that your marketing offer and messaging are working well). Conversion rates go between 0 to 1.

Average deposit – The average value of your first deposit converted into your reporting currency, (maybe USD, EUR or GBP etc). You’ll want to look at deposits from the campaign in question during the time frame and then average the values so you can find a close enough idea of how much each new client is worth to you.

Cost of marketing – The cost of marketing metric is the total amount you have invested in the marketing campaign that you are calculating, based on a specific time frame.

As a Forex broker, you should account for any all promotions or bonuses, Affiliate / IB payments, as well as advertising spend tied to the campaign within that period.

Example

Now let’s apply the formula to an example.

Your display advertising campaign from June 1st and June 30th generated 1000 Leads, out of which 30% converted into active clients. Their average deposit was $150, and your overall marketing campaign cost for the period was $3000.

[(1000 x 0.30 x 150) – 3000] / 3000 = 14

So for every $1 spent on that campaign you received approximately $14

That’s a fantastic ROI for that period. Comparing it to other campaigns, you’ll be able to tell which campaign is doing well and which should be improved or stopped completely. Just keep in mind that some figures like revenue are lagging behind the date that a trader is created and your data is often skewed, so make sure to pick time frames that work best for you.

Why do we need marketing campaign ROI stats?

Calculating your campaign ROI helps you ensure that you are making good decisions on the channels that you are using. Smart marketers know which channels are working well and when to pivot. They can identify which campaigns are helping to generate the most Forex leads for the least cost, and know which ads are seeing the highest conversions rates.

The information you gather from all your ROI calculations will help you tailor your marketing mix choices across the year. You’ll want to make sure your teams stay on top of the stats frequently.

One advantage of working in a digital marketing world is that all the information needed to implement the ROI formula and marketing returns analysis can be easily found in platforms such as:

- Your Forex CRM

- Advertising platforms

- Data from your Analytics accounts

The importance of a Forex CRM

Apart from the general data collection and analysis aspects, your Forex CRM should be set up to efficiently pass leads to sales, and allow you to quickly spot trends in the following areas:

- Lead entry points

- Lead source revenue

- Lead status

- Demo account activity

- Client preferences

Our clients enjoy using CurrentDesk’s revenue reporting as it enables them to do more straightforward ROI calculations, saving their team a lot of time.

Final thoughts

Keeping an eye on your conversion rates and revenues is easy to do with a Forex CRM. It will help your teams focus on growing ROI from your marketing campaigns, highlighting problems in your sales funnel and enabling you to fix them.

Focusing on acquisition is one key part of growing your brokerage. The cheaper you can generate leads for your sales team, and the more they convert into paid customers, the better your business is positioned to compete in the marketplace. But don’t forget the importance of client retention! Your acquisition efforts, and return on investment, are watered down if you have a leaky retention system in place, and clients leave too quickly before they achieve maximum value for your business.

If you’re looking for more tips on Forex brokerage marketing, you can find them in the broker marketing guide below.

Comments are closed.