APAC | How to start a Forex Brokerage targeting Asia and the South Pacific

What you need to know about working with forex clients in Asia and the South Pacific

The Asia-Pacific (APAC) market has presented a lucrative opportunity for forex brokers in recent years. As ESMA has tightened regulations in the European Union, many firms have expanded their offerings in Asia, including opening fully-staffed offices in the APAC region.

APAC typically includes China, Japan, countries in Southeast Asia, Australia, and island countries in the Pacific Ocean. The region covers a vast area and includes many different regulatory environments. Because Australia’s market and regulatory system are similar to those in Europe, we’re not focusing on it here.

This article discusses the tools you need to succeed in China, Southeast Asia, and countries in the Pacific.

Special considerations

APAC is an exceptionally diverse region. That said, there are a few things to keep in mind for clients throughout the area.

Asian investors generally value personal relationships, and they may be more likely to invest if they know someone at your firm. For this reason, introducing brokers (IBs) are essential for doing business with many forex clients in China and Southeast Asia. You’ll need to recruit multiple IBs to experience the maximum potential for growth in the region.

Asian investors generally value personal relationships, and they may be more likely to invest if they know someone at your firm. For this reason, introducing brokers (IBs) are essential for doing business with many forex clients in China and Southeast Asia. You’ll need to recruit multiple IBs to experience the maximum potential for growth in the region.

You will also likely need to work with several local PSPs. AliPay is the largest mobile wallet for Chinese clients, and TrueMoney is popular in Thailand, the Philippines, and Indonesia. Look for a PSP that can accommodate both of those payment types. You’ll also want a PSP that can connect to your forex CRM. PSPs and software providers use application program interfaces (APIs) to do this. Ask your software provider which Asian PSPs are pre-integrated in their tools.

Another local service you’ll need to look into is server hosting. To minimize latency and offer the best service, you need to have servers in Southeast Asia. Many software providers and turnkey broker solutions offer hosting in different locations, so talk to your existing service providers to see if they can help you find a hosting service in one of the countries you plan to target.

Licensing and regulations

Some brokers open offices in Asia or the Pacific so they can offer bonuses and more leverage than is allowed by regulations in other locations. You can operate in the APAC region without a license, though you should speak with a legal advisor before you set up an unlicensed business.

However, many clients are more comfortable working with a regulated broker. If you want to get a license in the region, there are two popular options: Hong Kong and Vanuatu.

The financial regulatory authority in Hong Kong is the Hong Kong Securities and Futures Commission (SFC). The SFC has a minimum capital requirement of 5 million HKD, and the process for obtaining a license is somewhat slow. That said, Hong Kong is the financial center of the region, so an SFC license will set you up for long term success in many APAC countries. Mainland China is the exception to this. SFC licensed brokers cannot offer services to clients in mainland China because margin trading is prohibited there. The SFC also limits leverage offerings to 20:1.

Many brokers who don’t have the minimum capital and those who want more freedom in their offerings choose to seek a license in Vanuatu. The small island-nation has a low minimum deposit for brokers, and the process is generally faster than that in Hong Kong. However, in August 2019, the VanuatuFinancial Services Commission announced the director of brokerages would be required to maintain residency in the country at least six months each year.

Marketing your forex brokerage in APAC

Marketing will vary greatly within this region. In most APAC countries, you can use Facebook as you would in European countries and you can optimize your website with SEO practices so that it ranks well in Google.

Both Google and Facebook are banned in mainland China; however, they are available in Hong Kong. If you plan to mainly work with clients in Hong Kong, you don’t need to use any Chinese-specific platforms. If you want to target clients in mainland China, you will need to use different marketing platforms.

QZone, created by the same company that made WeChat, is a social media site that allows users to write blog posts, keep journals, and share photos. It’s very popular in China, with over half a billion monthly users. As with Facebook, you can make an account for your brokerage on QZone and run advertising campaigns on the platform. QZone doesn’t have an English language site, so to use it, you’ll need to either be fluent in Chinese or work with a partner who is. Even though Facebook and Google are available in Hong Kong, you may benefit from having an account on a social media site like QZone since some people in that area might prefer QZOne to Facebook.

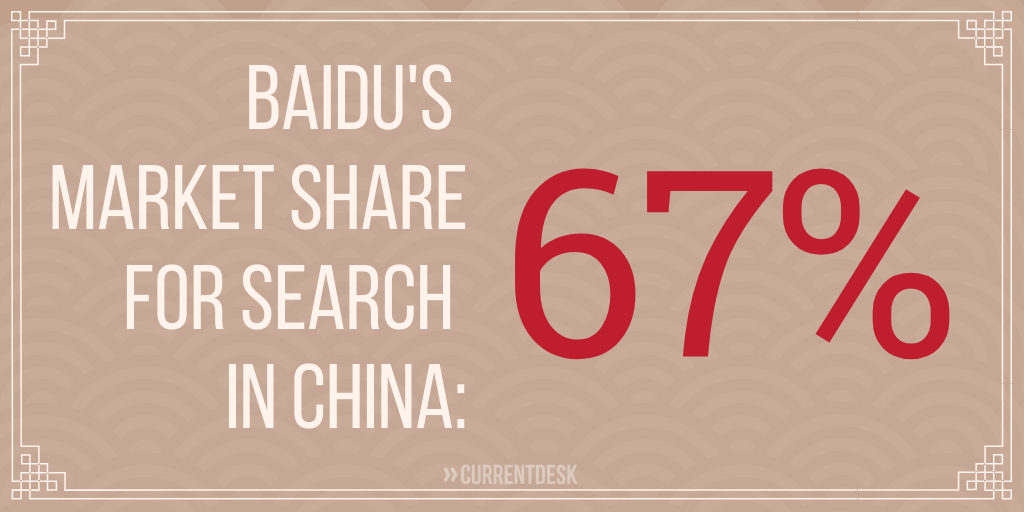

In addition to different social media platforms, you’ll also need a separate website if you want to target forex traders in mainland China successfully. Because China has banned all of Google’s services in the country, having cookies from Google Analytics may make your website unavailable in China. Set up a website specifically for the Chinese market and run Baidu ads. Baidu is the most popular search engine in China. Its ranking algorithm prioritizes showing the websites for companies that spend money on Baidu ads and have a fast loading time, unlike Google which prioritizes content. Because Baidu doesn’t have an English-language site, you’ll likely need to partner with a marketing professional in China or with one of your local IBs to place ads and rank in its searches.

Software tools for forex brokers

You don’t need special software to operate in APAC. However, you should make sure your existing back office software and CRM offer the tools you need to cater to the forex demands of the region.

Multi-level partnership management:

Personal relationships are key to success in the APAC region. You’ll need to attract the best IBs to succeed here, and offering an excellent experience to them is essential. Your software will need to provide them with the information they need in their preferred language. Look for software with a multilingual admin portal that also has granular control so you can easily determine what client info IBs can access.

Multilingual client cabinet:

You’ll need a software available in the languages your clients are most comfortable speaking. For China, Hong Kong, Taiwan and Singapore, your trader’s room will need to be available in traditional and simplified Chinese. Consider whether your software also needs to be available in Vietnamese, Thai, or Malay if you will be focusing on Vietnam, Thailand, or Malaysia and Indonesia, respectively.

Payment integration:

Getting money in and out of some countries in APAC can be complicated, so you’ll need local PSPs. To ensure it’s simple for clients to make deposits, look for a software that has an API so you can easily integrate with whichever PSPs you choose.

Marketing tools:

Since marketing in China is difficult if you don’t speak Chinese or have a local partner, you need excellent marketing tools in your forex CRM. Look for software that can send emails and nurture leads based on the data you’ve collected about a lead and any activity they’ve had with your demo accounts.

Success in the APAC region requires dedication and time. You’ll need to make sure you’re offering both clients and IBs what they want. You’ll also have to navigate a complicated payment processing system and different marketing platforms. Working with a software provider that has experience with the forex market in APAC can make things easier. In the end, the effort you put into developing your business in the region can pay off with new clients and strong growth.

You should always speak to a legal advisor before making decisions about regulations. Our blog posts should not be considered legal advice.

Comments are closed.