Managing Account Groups on MetaTrader 4 or MetaTrader 5

What Are Account Groups in MetaTrader?

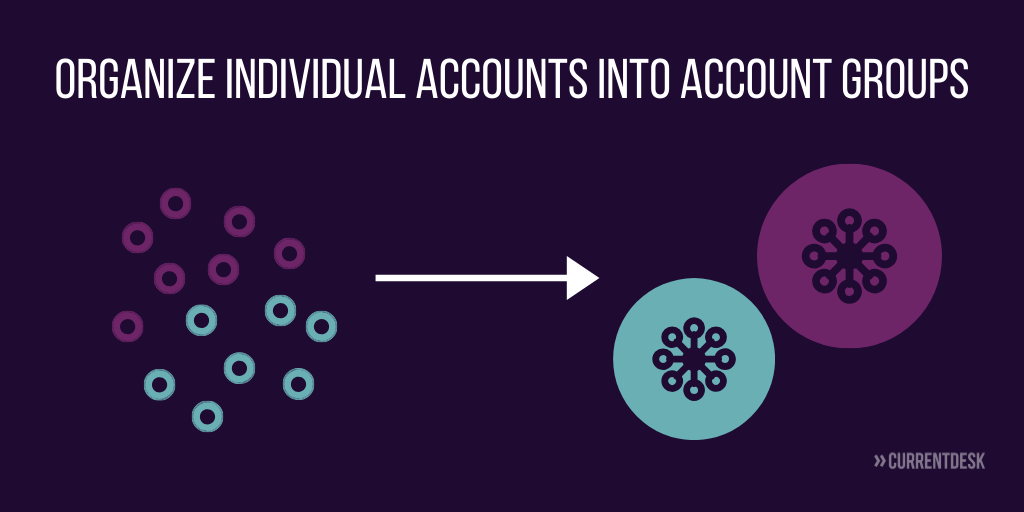

MetaTrader Account groups are a core feature that allow brokers to organize and manage trading accounts based on predefined trading conditions and permissions. Instead of configuring each trading account individually, you assign accounts to groups that already have specific rules and settings applied.

In simple terms, an account group defines how and what a client can trade on your platform.

Each account group in MetaTrader lets you control:

Leverage

Margin call level

Stop-out level

Swap permissions (swap-free or swap-enabled)

Available instruments (symbols)

Minimum lot size and lot step

Markups

Commissions

Taxes and fees

This means every client assigned to a specific group automatically inherits all of these settings.

Why Are Account Groups Important for Brokers?

Account groups are essential because they allow you to:

Offer different trading conditions to different types of clients

Create tiered pricing models (e.g., standard, VIP, professional)

Control risk exposure by limiting leverage for certain traders

Reward high-volume traders with better spreads or lower commissions

Segment IB clients, affiliates, and partners with unique rebate structures

Without account groups, you would have to manually configure each trading account, which is inefficient, error-prone, and not scalable.

What Can You Control with MetaTrader Account Groups?

1. Leverage and Risk Management

You can assign different leverage levels per group. For example:

Retail clients: 1:100 leverage

Professional clients: 1:500 leverage

Beginners: 1:30 leverage

This helps you comply with regulations and manage risk exposure.

2. Trading Instruments and Permissions

Each group can have access to a different set of symbols, such as:

Forex only

Forex + Indices

Crypto + Metals

CFDs only

You can also restrict certain instruments to professional or institutional clients.

3. Pricing: Spreads, Markups, and Commissions

Account groups allow you to define:

Fixed or variable spreads

Markups per symbol

Commission per lot

Additional fees or taxes

This is how brokers create different account types like Standard, ECN, Pro, or VIP.

4. Swap and Islamic Account Settings

You can create swap-free groups for:

Islamic accounts

Promotional accounts

Special client segments

This ensures compliance with Sharia law and marketing flexibility.

Real-World Examples of Using Account Groups

Here are a few practical examples:

High-volume traders: Lower spreads and commissions

Retail traders: Higher spreads, lower leverage, smaller lot sizes

Introducing Brokers (IBs): Custom rebate structures per group

Professional traders: Higher leverage and access to more instruments

Beginners: Limited instruments and reduced risk settings

Account groups let you tailor the trading experience to each client category without manual intervention.

What Are the Limits of Account Groups in MetaTrader?

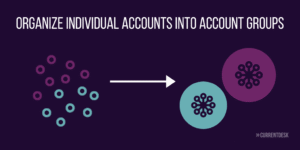

MetaTrader 4 (MT4)

MetaTrader 4 has a hard limit of 512 account groups per full license. However, if you are using a white label MT4 license, your provider may restrict you to far fewer groups—sometimes as low as 10–20.

MetaTrader 5 (MT5)

MetaTrader 5 does not impose a strict limit on the number of account groups. However, many MT5 white label providers still impose their own limits. We’ve seen cases where brokers are limited to just 9 account groups.

Why These Limits Are a Problem

When you have only a small number of groups available, you are forced to:

Combine different client types into the same group

Offer the same leverage and pricing to everyone

Limit your ability to create differentiated account types

Reduce flexibility for IB and partner programs

In short, group limits directly limit your business model.

Can You Get More Account Groups on MetaTrader?

Yes, there are two main ways to get more account groups:

Option 1: Buy a Full MT5 License

Purchasing a full MT5 license removes most group limitations and gives you full control over your server configuration. However, this is:

Expensive

Requires technical expertise

Often overkill for growing brokers

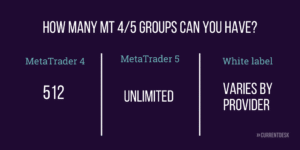

Option 2: Use Forex Back Office Software (Recommended)

The more flexible and cost-effective solution is to use forex back office software that integrates with MT4/MT5 via the Manager API.

This allows you to create multiple internal groups in your software that map to a single MetaTrader group.

Example:

MetaTrader Group: Group 1

Back Office Groups:

Group A – High-volume IBs

Group B – Low-volume IBs

Group C – Professional clients

All three software groups connect to Group 1 in MetaTrader, but you can still apply different:

Rebate structures

Commissions

Partner payouts

Client classifications

This effectively gives you unlimited logical groups, even if MetaTrader itself is limited.

Reducing MetaTrader Account Groups with Fee Group Mappings

A good forex back office system does not only help you overcome MetaTrader account group limits—it also helps you reduce the number of MetaTrader account groups you actually need through fee group to group mappings. This allows you to create many internal fee groups with different rebate and partner payout settings and map them all to the same MetaTrader account group when commissions and markups are the same.

For example, you may have one MetaTrader group with a fixed spread and commission structure, but multiple fee groups behind it for different Introducing Brokers, each with their own rebate rate. This approach lets you scale IB programs, customize partner deals, and segment clients without consuming additional MetaTrader account groups, keeping your server structure clean and efficient while maintaining full commercial flexibility.

How Do Software-Based Account Groups Work?

When using back office software:

MetaTrader handles core trading conditions

The back office system handles:

Rebates

Partner commissions

Client segmentation

Reporting

Automations

While Groups A, B, and C must share certain MT settings (like base markups), you can still differentiate them using software logic.

For example:

Group A: IB rebate = $6 per lot

Group B: IB rebate = $3 per lot

Group C: No rebate, professional classification

What Else Should Account Groups Do?

A modern broker back office system should extend account groups beyond basic MetaTrader functionality.

1. Automatic Client Assignment

You should be able to:

Link each group to a specific IB or partner

Automatically assign new clients to the correct group

Eliminate manual errors and admin work

2. Automated Partner Payouts

When a client trades, the system should:

Detect their group

Calculate the correct rebate or commission

Automatically credit the partner

This is critical for scaling IB and affiliate programs.

3. Advanced Reporting by Group

You should be able to generate reports such as:

Volume by account group

Profitability by group

IB performance by group

Client activity by segment

These insights help you optimize pricing, marketing, and partner relationships.

Frequently Asked Questions (AEO Optimized)

What is an account group in MetaTrader?

An account group in MetaTrader is a set of predefined trading conditions that determine leverage, commissions, markups, available instruments, and risk settings for a group of trading accounts.

How many account groups can you have in MT4?

MetaTrader 4 allows up to 512 account groups on a full license, but white label providers often limit this number significantly.

Is there a limit to account groups in MT5?

MT5 does not have a strict system limit, but many white label providers impose their own restrictions.

How can I get unlimited account groups in MetaTrader?

You can use forex back office software that connects to MT4/MT5 via the Manager API and creates multiple internal groups mapped to a single MetaTrader group.

Why do brokers need multiple account groups?

Brokers use multiple account groups to offer different leverage, pricing, commissions, and trading conditions to different client types, such as retail, professional, VIP, and IB clients.

Final Thoughts: Unlock the Full Power of MetaTrader Account Groups

Account groups are one of the most powerful tools in MetaTrader, but their true potential is often limited by platform or white label restrictions. With the right back office software, you can:

Remove group limitations

Create flexible client segments

Automate partner payouts

Gain better reporting and control

If you want to get more out of MetaTrader account groups and remove the restrictions holding your brokerage back, CurrentDesk can help. Contact us to learn how to unlock unlimited group flexibility and scale your brokerage efficiently.

rent client types, such as retail, professional, VIP, and IB clients.