CLIENT PORTAL FOR FOREX BROKERS

Industry Leading Forex Trader Portal Increases Engagement with Traders

Create branded

Interac with all your traders within a single application. View requests from your client and respond with standard responses or emails

Scalable infrastructure

Interac with all your traders within a single application. View requests from your client and respond with standard responses or emails

Streamline on-boarding

Register leads, clients and partners, perform KYC or Auth-KYC, and get deposits in within minutes.

Perform efficient

and painless KYC validations, either manually or with an automated process.

Connect with your clients by using

Built-in advertising space and custom notifications

OUR FEATURES

All-in-One Forex CRM and Back Office Platform Built with Forex Trader Portal, for your Success

Multi-Language Control

Choose language preferences directly from the admin panel and send branded e-statement reports. Maintain consistent visual identity across signups, logins, emails, and deposits.

Enterprise-Grade

Deploy professional client portal tools instantly—no need to build or maintain infrastructure yourself.

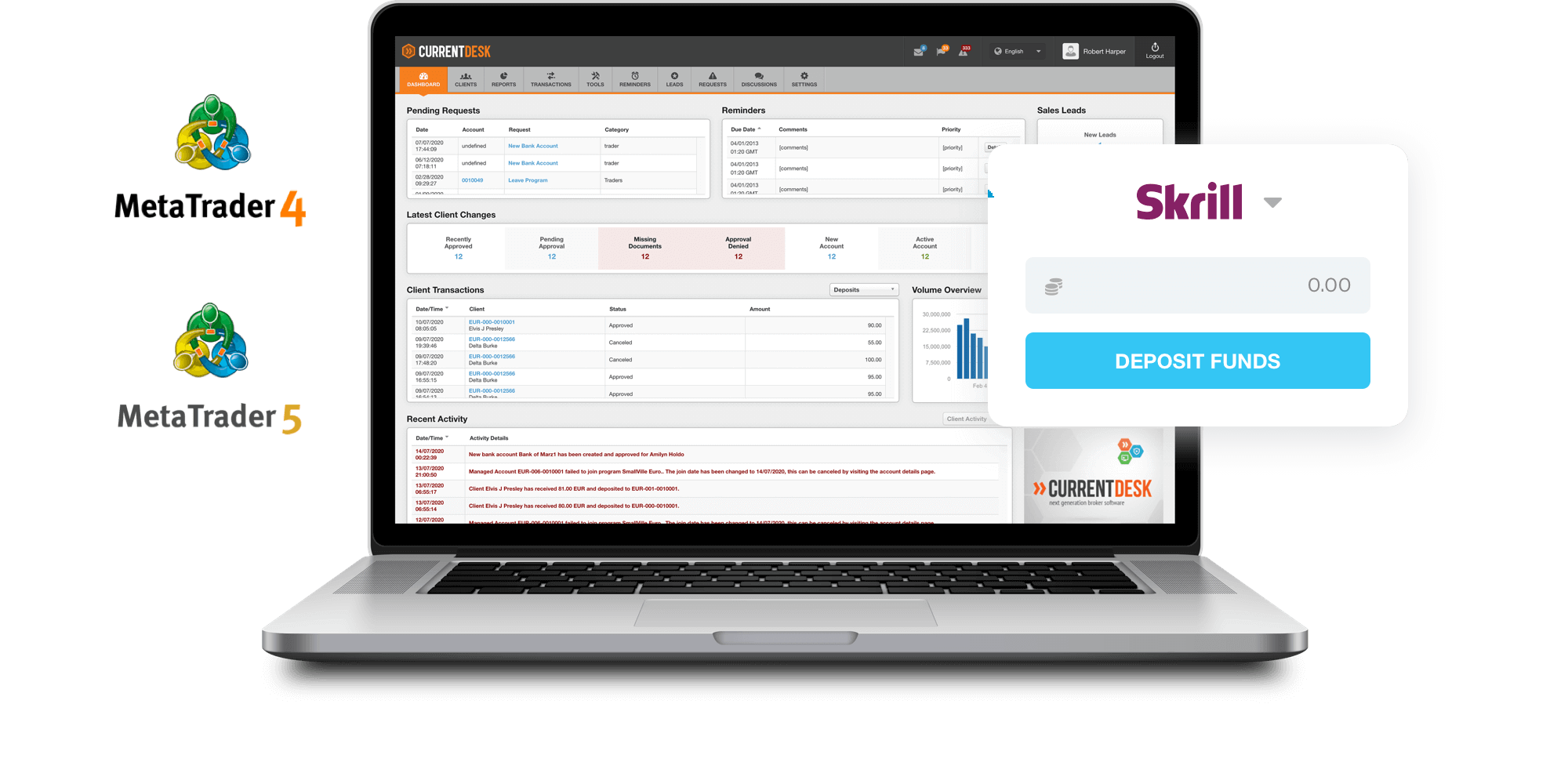

Multi-Platform Connectivity

Connect multiple trading platforms to process deposits, currency conversions, and managed account allocations effortlessly.

Allow clients to have different platforms under one Forex Client Portal, whether they are trading on MetaTrader4, MetaTrader5, Shift Crypto Trader or any other which we can integrate with

White Label Support Tools

Offer your White Labels robust trader management systems to help them grow efficiently and boost profitability.

Portals & Payment Flexibility

Create localized sign-up forms and custom portal interfaces for traders. Allow quick deposits using major pre-integrated PSPs.

Zero Development Setup

Get started without coding or development delays—traders can begin trading sooner.

Streamlined KYC Workflow

Simplify verification and account opening with document uploads and real-time review during or after registration. Automate KYC completely through our Auto KYC integration to achieve a registration to deposit process of under 5 minutes.

Automated Reminders

Send auto-reminders from the document center to chase incomplete uploads and increase approval rates.

Effortless Compliance

Ensure compliance without burdening clients or administrators through automated checks and document tracking.

Bonus and Loyalty Module

Drive client on-boarding and referrals with our advanced bonus module. Bonuses are automatically allocated and can be converted into trading balance if desired, helping to boost trading activity. The system also includes safeguards against excessive losses and abusive behavior, such as moving funds between accounts to exploit bonuses.

Social Trading

Generate more volume with our integration to social trading services. Your clients can have multiple accounts all under the same profile, some to trade independently, others to be managed by a mam and yet others for social trading.

OUR INNOVATIVE SERVICES

Building and crafting your digital future

Automated client-onboarding

Traders can open accounts directly from your web forms, get emailed login details automatically, and make a deposit within minutes.

Instantly deployed tools

Deploy your enterprise-grade client portal within a few clicks. Custom brand it how you wish and easily connect it to all your platforms.

Boost client engagement

Display marketing campaign messaging with inbuilt advert placements and use the trader notifications tools to personalize and influence their activities.

Optimize your brokerage business today

FAQ

Below — we answer the most common questions brokers ask about the CurrentDesk Forex broker CRM: from security and scalability to integrations, compliance, and real-world onboarding timelines. If your question isn’t covered here — or you’d like more detail — feel free to contact us directly.

- Q: Does CurrentDesk have a client portal?

A: Yes, the CurrentDesk CRM system includes a powerful, user-friendly Forex client portal. The interface is designed to closely resemble modern online banking platforms, making it familiar and intuitive for users. Through this portal, clients can efficiently manage their funds, view balances and transaction history, run detailed reports, upload and manage KYC documents, submit support requests, and monitor trading activity. The client portal enhances transparency, improves user engagement, and dramatically reduces the operational workload for your internal support team.

- Q: Does CurrentDesk have a partner portal?

A: Yes, the CurrentDesk CRM system also offers a comprehensive Forex partner portal. This dedicated space functions as a mini CRM specifically for Introducing Brokers (IBs) and Asset Managers (AMs). Partners can monitor their referrals in real time, track commissions and rebates, access marketing materials, communicate with clients, and manage performance metrics. This suite empowers partners to efficiently grow their business while strengthening your brokerage’s partner network.

- Q: What types of Partner (IB or AM) programs does CurrentDesk offer?

A: The CurrentDesk CRM supports three distinct partner models to accommodate different business strategies. You can configure rebates based on trading account groupings, allocate commissions between multiple partners from a single trading account, or build advanced multi-level hierarchies using a rebate allocation tree. This flexibility allows you to create tailored, scalable partner programs that align with your business structure.

- Q: Does your system have a loyalty or bonus program?

A: Yes, CurrentDesk offers such a solution. Clients can get bonuses for quick on-boarding, making deposits, and referring other clients. Clients will see the bonuses in their Forex Trader portal. For more info please read about our bonus module.

- Q: Is CurrentDesk integrated with payment providers (PSP) or payment gateways?

A: Yes CurrentDesk is integrated with many PSPs and also with a payment gate way. You can access to hundreds of PSP. As per request, we can integrate to additional PSP. In addition CiurrentDesk has a flexible secure API which allows you to integrate to any PSP you choose. Clients can make deposits securely directly through their Forex Trader portal.

- Q: Does CurrentDesk offer some tool so that we can easily market to our clients based on region or trading activity or any other parameter?

A: There is an advanced marketing area in the CurrentDesk system. You can segment client based on trading activity, languages, regions and other parameters to better target the right clients with the right information.

- Q: Do you support white labeling for multiple brands?

A: Yes, the CurrentDesk Forex CRM fully supports white labeling. This allows brokers managing multiple brands to maintain consistent infrastructure while customizing the front-end identity for each brand

- Q: Can the Forex back office support multiple regions and languages?

A: Yes, the CurrentDesk Forex back office is built to support multi-language and multi-region operations. This feature is particularly valuable for brokers working with international clients, as it enables localized experiences, regional compliance flexibility, and customized onboarding processes to match the requirements of different jurisdictions.

- Q: What kinds of payment methods and local payment options are supported?

A: CurrentDesk already integrates with hundreds of Payment Service Providers (PSPs) and includes a flexible, secure API — which means you (or your clients) can use a wide variety of deposit and withdrawal methods. These typically include: bank transfers, e-wallets, local payment options (depending on region), and credit/debit cards (where compliant).

If you have a preferred payment provider that is not already integrated, we can review and — subject to technical and security evaluation — add it to the system. This ensures that you can cater to local payment preferences of your clients, which is especially important for global and regionally diverse brokerages.

- Q: Can I link CurrentDesk to external tools — for example CRM, analytics, or marketing automation?

A: Yes — the CurrentDesk Forex CRM is built with extensibility in mind. Through its secure API and modular architecture, you can integrate third-party systems such as: CRM tools, marketing automation platforms, external BI or analytics software, or other financial services tools.

Each integration request is subject to a technical and security review to ensure compatibility and protect data integrity. Once approved, integrations are implemented smoothly — allowing you to extend functionality without compromising system stability.

- Q: How does CurrentDesk handle data privacy and compliance with international regulations?

A: Data privacy is a core feature of the CurrentDesk FX CRM. Because we are ISO 27001:2022 certified, we adhere to internationally recognized standards for information security management. This includes secure data storage, encrypted communication channels, access control, and periodic audits to maintain compliance.

When onboarding clients from different jurisdictions, CurrentDesk enables tailored compliance workflows to meet regional regulatory requirements (e.g., KYC, AML, documentation, regional tax or reporting rules). This makes it easier for global brokers to run a compliant operation without manually adapting processes for each region.