FOREX CRM FOR BROKERS

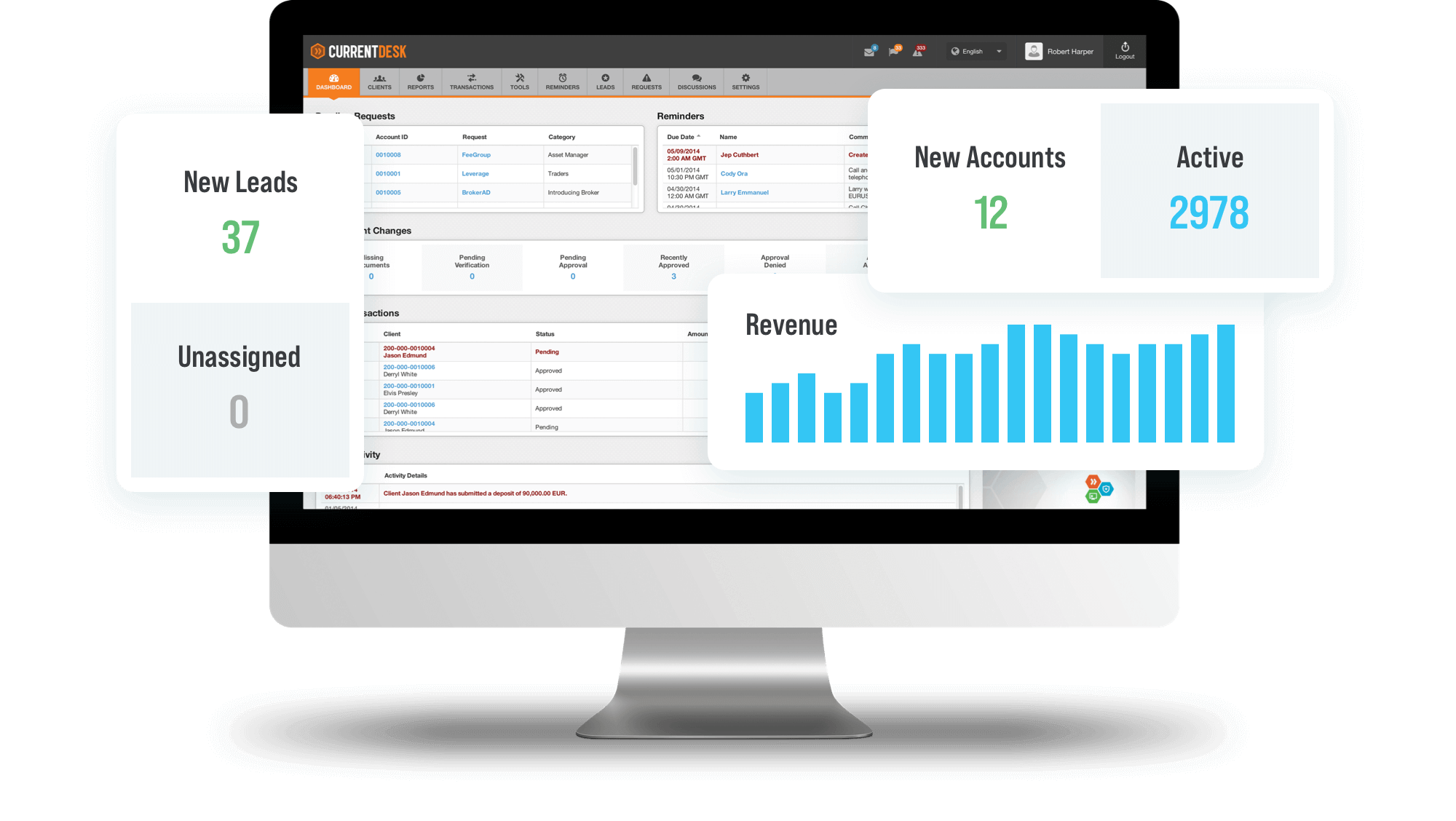

Convert more Visitors into Active Traders with CurrentDesk's Forex CRM Software

Optimize your entire process

Optimize your entire process

For sales, know your customers, on-boarding and deposits.

Build stronger relationships

With clients and partners by keeping notes and sending targeted emails.

Drive traffic & boost leads

With targeted marketing campaigns and partner relationship tools.

Connect seamlessly

To MetaTrader 4, MetaTrader 5, Shift Trader and other major platforms.

Track lead flow and convert more leads into active traders!

OUR CRM RELATED FEATURES

All-in-One Forex CRM Platform Built for your Success

Automated Onboarding

Activate smart on-boarding in your brokerage CRM workflows that assign new leads to the right sales representatives based on language and/or region and reduce first-contact times. Automate KYC so that clients can deposit within minutes of registration.

Real-Time Revenue Reports

See exactly how much revenue you have generated over the past 24 hours—or any custom time period—through real-time reporting from all connected trade platforms. The CurrentDesk Forex CRM solution automatically calculates revenue from spreads, commissions, transaction fees, and swap charges, eliminating the need for manual calculations and saving your team valuable time every day.

Unified Lead Profiles

Keep detailed demographic profiles for every lead, client, and partner in one centralized, data-rich dashboard. With the CurrentDesk Forex CRM Solution, you can track key information and automatically link leads to clients upon conversion, ensuring a seamless view of the customer journey and better insights for sales and support teams.

Custom User Registration

Register new clients, partners, and leads directly through your website via API, including custom fields to capture business-specific details. The CurrentDesk CRM also allows you to track the source of every client and lead, providing valuable insights for marketing and business development.

Campaign Tracking & Attribution

Create email campaign and marketing campaign codes, as well as payout structures to easily track performance and marketing attribution with your Forex CRM ecosystem.

Send targeted campaigns to client subsets based on location, language, trading habits and many other parameters

Smart Email Automation

Create branded HTML email templates and set up automated responses triggered by specific user actions or audience segments. With the CurrentDesk Forex CRM, you can engage clients and leads efficiently, delivering timely, personalized communications that improve retention and conversion.

Partner & Referral Tracking

Track client referrals and reward your partners and IBs for driving new business with advanced link tracking. You can also incentivize clients for referring others. Create referral links automatically or manually within the CurrentDesk FX CRM to streamline rewards and monitor performance.

Multi-Tier Partner Network

Enable self-registration for partners, manage commissions, and configure unlimited multi-tier IB partnerships to grow your network efficiently. Compatible with a variety of trading platforms, be it MetaTrader 4, MetaTrader 5, ShiftTrader, etc.

Trading Platform Integration

Synchronize trading accounts automatically with MetaTrader 4, MT5, ShiftTrader and other platforms for seamless business operations. If we are not integrated with your platform we can add it.

Click to call

Improve sales team efficiency by leveraging CurrentDesk’s click to call integration with Twilio voice

Social Trading

Generate more volume with our integration to social trading services. Your clients can have multiple accounts all under the same profile, some to trade independently, others to be managed by a mam and yet others for social trading.

Advanced Analytics & Reporting

Automatically calculate daily trade and transaction revenue using flexible business rules, multiple commission models, and rebate structures—including two multi-level systems—with layered analytics for deeper insights.

Track the number of deposits and total trading volume generated by each salesperson, and foster healthy inter-departmental competition by showing performance comparisons across your team.

Sales teams can easily monitor the status of leads and the progress of client onboarding, allowing them to engage proactively and address any bottlenecks.

With CurrentDesk’s Forex CRM solutions, these insights provide a complete, real-time view of your brokerage’s performance, empowering teams to optimize revenue and client engagement.

OUR INNOVATIVE SERVICES

Building and crafting your digital future

Boost conversions

Use smart lead routing rules to automatically pass leads to sales staff so that they can quickly reach out to warm prospects and convert them while interest is high.

Get clearer insights

Centralize your data from multiple platforms. Get one single view of a trader and use real-time notifications to help you focus on revenue driving activities.

Retain clients longer

Create powerful reports to help your sales and marketing teams know which retention campaigns are working well, and which need some improvement.

Optimize your brokerage business today

FAQ

Below — we answer the most common questions brokers ask about the CurrentDesk Forex broker CRM: from security and scalability to integrations, compliance, and real-world onboarding timelines. If your question isn’t covered here — or you’d like more detail — feel free to contact us directly.

- Q: Does CurrentDesk have a client portal?

A: Yes, the CurrentDesk FX CRM system includes a powerful, user-friendly client portal. The interface is designed to closely resemble modern online banking platforms, making it familiar and intuitive for users. Through this portal, clients can efficiently manage their funds, view balances and transaction history, run detailed reports, upload and manage KYC documents, submit support requests, and monitor trading activity. The client portal enhances transparency, improves user engagement, and dramatically reduces the operational workload for your internal support team.

- Q: Does CurrentDesk have a partner portal?

A: Yes, the CurrentDesk Forex CRM system also offers a comprehensive partner portal. This dedicated space functions as a mini CRM specifically for Introducing Brokers (IBs) and Asset Managers (AMs). Partners can monitor their referrals in real time, track commissions and rebates, access marketing materials, communicate with clients, and manage performance metrics. This suite empowers partners to efficiently grow their business while strengthening your brokerage’s partner network.

- Q: What types of Partner (IB or AM) programs does CurrentDesk offer?

A: The CurrentDesk FX CRM supports three distinct partner models to accommodate different business strategies. You can configure rebates based on trading account groupings, allocate commissions between multiple partners from a single trading account, or build advanced multi-level hierarchies using a rebate allocation tree. This flexibility allows you to create tailored, scalable partner programs that align with your business structure.

- Q: Does your system have a loyalty or bonus program?

A: Yes, CurrentDesk offers such a solution. Clients can get bonuses for quick on-boarding, making deposits, and referring other clients. For more info please read about our bonus module.

- Q: Is CurrentDesk integrated with payment providers (PSP) or payment gateways?

A: Yes CurrentDesk is integrated with many PSPs and also with a payment gate way. You can access to hundreds of PSP. As per request, we can integrate to additional PSP.

In addition CiurrentDesk has a flexible secure API which allows you to integrate to any PSP you choose.

- Q: Does CurrentDesk have a compliance tool?

A: Yes, CurrentDesk includes KYC tool which is built in. If you are looking for advanced auto KYC in order to on-board clients in minutes, then we are integrated with SumSub.

- Q: Does CurrentDesk offer some tool so that we can easily market to our clients based on region or trading activity or any other parameter?

A: There is an advanced marketing area in the CurrentDesk system. You can segment client based on trading activity, languages, regions and other parameters to better target the right clients with the right information.

- Q: Do you support white labeling for multiple brands?

A: Yes, the CurrentDesk Forex CRM fully supports white labeling. This allows brokers managing multiple brands to maintain consistent infrastructure while customizing the front-end identity for each brand.

- Q: Is the CurrentDesk Forex back office separate from the CRM?

A: No, the CurrentDesk solution is a fully unified system. The Forex CRM, client portal, and partner portal are all included in one cohesive, cost-effective platform. It is suitable for brokers of all sizes, from startups to established industry leaders.

- Q: What types of reports are included in the CurrentDesk Forex back office?

A: The CurrentDesk Forex back office provides access to more than 25 advanced reports, including end-of-day summaries, rebate and bonus reports, account statements, compliance monitoring, and detailed sales and marketing analytics. These reports give you valuable business intelligence to support strategic decisions.

- Q: Does CurrentDesk offer system customization?

A: Yes, customization is available within the CurrentDesk FX CRM. Frequently requested enhancements may be delivered at no additional cost if they benefit multiple clients. Highly specialized or unique modifications may involve an additional development fee.

- Q: Can the Forex back office support multiple regions and languages?

A: Yes, the CurrentDesk Forex back office is built to support multi-language and multi-region operations. This feature is particularly valuable for brokers working with international clients, as it enables localized experiences, regional compliance flexibility, and customized onboarding processes to match the requirements of different jurisdictions.

- Q: Is the CurrentDesk Forex back office suitable for startup brokers?

A: Yes, the CurrentDesk Forex CRM is specifically designed to support both new and established brokers. For startups, it provides all essential tools—from CRM and client management to compliance, reporting, and payment integrations—within a single platform. This significantly lowers operational and technical barriers, allowing new brokers to launch quickly, scale efficiently, and remain fully compliant from day one.

- Q: How long does it take to deploy CurrentDesk for a new broker?

A: For a new brokerage that does not require legacy data migration, CurrentDesk can often be deployed and operational within one business day, provided that the necessary setup information is delivered promptly. This rapid “go-live” timeframe includes account initialization, basic configuration, and access provisioning — ideal for start-ups eager to launch quickly.

If your setup requires migration of existing client, trade, or historic data, the timeline typically extends by 1–2 additional days, depending on data volume and format. In such cases we provide clear guidelines on data formatting and assist with migration to ensure seamless integration into the Forex back office.

- Q: What kind of reporting and analytics are available in the Forex back office?

A: The reporting module in CurrentDesk’s FX CRM offers over 25 built-in reports — but that’s just the beginning. Reports cover:

End-of-day summaries and P&L calculations, so you immediately know how much your brokerage earned each day.

Partner rebate and commission reports — detailing which IBs or AMs generated commissions, their respective shares, and pending payments.

Client account statements, deposit/withdrawal logs, and compliance-related reports (e.g., KYC status, document expiration).

Marketing & sales analytics: you can track client acquisition, activity patterns, and deposit trends to support data-driven growth decisions.

Export tools: each report can be exported to Excel or CSV, enabling deeper external analysis, custom dashboards, or integration with your internal BI systems.

These reporting capabilities make the Forex back office not just an operations tool — but a full business intelligence hub for your brokerage.

- Q: What kinds of payment methods and local payment options are supported?

A: CurrentDesk already integrates with hundreds of Payment Service Providers (PSPs) and includes a flexible, secure API — which means you (or your clients) can use a wide variety of deposit and withdrawal methods. These typically include: bank transfers, e-wallets, local payment options (depending on region), and credit/debit cards (where compliant).

If you have a preferred payment provider that is not already integrated, we can review and — subject to technical and security evaluation — add it to the system. This ensures that you can cater to local payment preferences of your clients, which is especially important for global and regionally diverse brokerages.

- Q: What is the support model at CurrentDesk? How do you handle issues or onboarding assistance?

A: CurrentDesk offers 24/7 support for critical issues affecting your Forex back office operations — such as system downtime, payment failures, or security incidents. For general questions, training, onboarding help, and configuration guidance, we provide 24/5 support.

Beyond reactive support, we also offer onboarding assistance, documentation, and training to help your team or partners make full use of features like client and partner portals, reporting, compliance, and integrations. If you need a custom workflow or feature after onboarding, we accept customization requests to adapt the system to your brokerage’s evolving needs.

- Q: Can I link CurrentDesk to external tools — for example CRM, analytics, or marketing automation?

A: Yes — the CurrentDesk Forex CRM is built with extensibility in mind. Through its secure API and modular architecture, you can integrate third-party systems such as: CRM tools, marketing automation platforms, external BI or analytics software, or other financial services tools.

Each integration request is subject to a technical and security review to ensure compatibility and protect data integrity. Once approved, integrations are implemented smoothly — allowing you to extend functionality without compromising system stability.

- Q: How does CurrentDesk handle data privacy and compliance with international regulations?

A: Data privacy is a core feature of the CurrentDesk FX CRM. Because we are ISO 27001:2022 certified, we adhere to internationally recognized standards for information security management. This includes secure data storage, encrypted communication channels, access control, and periodic audits to maintain compliance.

When onboarding clients from different jurisdictions, CurrentDesk enables tailored compliance workflows to meet regional regulatory requirements (e.g., KYC, AML, documentation, regional tax or reporting rules). This makes it easier for global brokers to run a compliant operation without manually adapting processes for each region.