Africa | Starting a Forex Brokerage

What You Need to Know About Working With Forex Clients in Africa

Meta description

Forex brokerages can attract new clients by expanding into Africa. The region offers strong growth potential for brokers. Learn what you need to start a forex broker in Africa, including regulation, payments, and marketing.

Developing in new regions to expand your client base is a smart way to grow your Forex brokerage and reduce risk from tightening regulations in Europe and other mature markets. Many brokers are now looking beyond the EU to regions with growing retail trading demand. We recently covered expansion opportunities in the Middle East and North Africa (ADD LINK ONCE PUBLISHED), but the majority of the African continent falls outside of that region and presents a distinct opportunity.

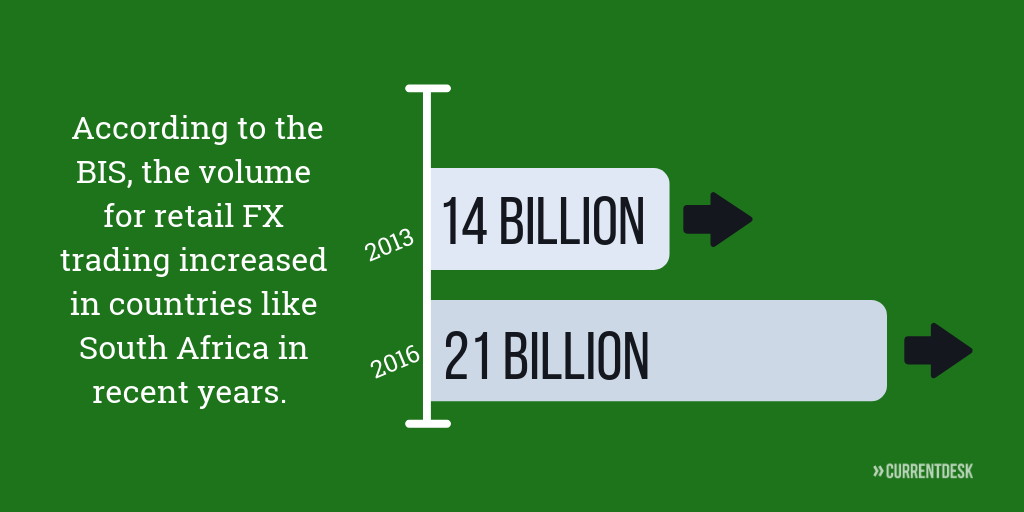

In recent years, demand for retail FX trading across Africa has grown steadily. According to the Bank for International Settlements, retail Forex trading volume in South Africa alone increased from $14 billion in 2013 to $21 billion in 2016, and the market has continued to develop since then. Improved internet access, mobile payments, and financial education have all contributed to this growth.

This article explains what you need to know to start a Forex broker in Africa or expand your existing brokerage into African markets, with a focus on payments, licensing, marketing, and technology.

Why Africa Is Attractive for Forex Brokers

Africa is one of the fastest-growing regions for retail financial services. A young population, increasing smartphone adoption, and limited access to traditional investment products make forex trading particularly appealing to retail traders.

Key advantages include:

A growing retail trading audience

Less regulatory pressure compared to Europe

Strong demand for introducing brokers (IBs) and partnerships

Increasing use of digital and mobile payment solutions

For brokers willing to understand local conditions, Africa offers long-term growth potential and diversification.

Currency and PSP Considerations

Africa consists of 54 countries and 45 unique currencies, which makes payment processing one of the most important operational considerations when you start a forex brokerage in Africa.

Because banking infrastructure varies widely by country, many traders rely on local payment methods, mobile money, or regional PSPs rather than international card networks. If you plan to serve clients in multiple African countries, you will likely need to integrate with more than one payment service provider (PSP).

Popular PSPs in Africa

DPO

One of the largest PSPs operating in Africa, DPO continues to expand through acquisitions of smaller providers. It has offices throughout the continent and in Ireland, making it suitable for brokers targeting multiple countries.Cellulant

Cellulant focuses on financial inclusion and mobile payments, with agent networks across Africa. It is especially useful if you plan to target traders in rural or underbanked regions.WireCard (formerly MyGate)

A global payment provider with African operations. While it has a strong international presence, it supports fewer African countries compared to DPO or Cellulant.

Your Forex back office and CRM software should be capable of integrating with these PSPs via API. Flexible payment integration is essential for smooth onboarding, deposits, and withdrawals in African markets.

Licensing and Regulation in Africa

Compared to the European Union, Africa offers fewer regulatory barriers for forex brokers. This is one reason many firms choose to start a forex brokerage in Africa or establish a regional office there.

Operating Without a Local License

In many African countries, it is possible to operate without holding a local regulatory license. However, brokers that choose this route must invest more effort into building trust, transparency, and brand credibility. This may include:

Clear risk disclosures

Strong customer support

Transparent pricing and execution

Reputable technology providers

Obtaining a Forex License in Africa

While not mandatory in all cases, holding a license can significantly improve client trust and conversion rates.

The two most recognized regulatory authorities are:

Financial Sector Conduct Authority (FSCA) – South Africa

Securities and Exchange Commission (SEC) – Nigeria

Of these, the FSCA is the most popular choice among forex brokers. South Africa has a well-developed forex market and is an excellent operational base for working with introducing brokers across the continent. The FSCA provides relatively clear guidance and publicly available information for brokerage licensing.

Marketing a Forex Brokerage in Africa

Marketing strategies in Africa are similar to other regions, but platform selection and compliance restrictions are especially important.

Social Media Marketing

Facebook is the dominant social platform in Africa, accounting for roughly 64% of social media activity on the continent. South Africa alone has around 16 million Facebook users.

Facebook ads, groups, and organic content are effective tools for lead generation and brand awareness.

Influencer partnerships and IB-led campaigns are also common.

YouTube and Education

YouTube is widely used across Africa and is particularly effective for educational content. Educational videos explaining forex basics, trading strategies, and risk management help establish trust and position your brokerage as an authority.

Educational marketing is especially important when you start a Forex brokerage in Africa, as many traders are new to financial markets.

SEO and Content Marketing

Google is the most widely used search engine in Africa. Search engine optimization (SEO) is critical because Google Ads does not allow Forex advertising in African countries, even if you hold a license.

Focus on:

Educational blog content

Forex guides and FAQs

Country-specific landing pages

Technical SEO and site performance

Google also provides free tools such as Google Search Console and Google Analytics to help optimize your website.

Software Tools for Running a Forex Brokerage in Africa

You can use most standard Forex trading platforms and CRMs in Africa, but certain features are especially valuable.

Key Software Features to Look For:

PSP API integrations

Your back office should support API-based integration with multiple PSPs to handle local payment methods efficiently.Multi-level partnership management

Introducing brokers are extremely popular in Africa. A Forex CRM that supports multi-level IB structures, automated commission calculation, and timely payouts is essential.Email marketing and automation

Since paid search advertising is restricted, email marketing becomes a core growth channel. Look for CRM software that allows segmentation, automation, and compliance-friendly communication.

👉 Read more about email marketing for Forex. (ADD LINK)

Final Thoughts: Is Africa Right for Your Forex Brokerage?

Expanding into a new region always comes with challenges, but Africa offers a rare combination of growth potential, market demand, and operational flexibility. With the right payment partners, software tools, and marketing strategy, it is entirely feasible to start a Forex broker in Africa or successfully expand an existing operation.

Once your infrastructure is in place, acquiring and retaining Forex clients in Africa is not fundamentally different from other regions—it simply requires local knowledge, adaptability, and long-term commitment.

If you invest in the right technology, partnerships, and educational marketing, Africa can become one of the strongest growth drivers for your brokerage business.