10 Things you Need to Start a Forex Broker

Choosing a Custom Forex Broker Solution

Subtitle: Choosing a custom Forex broker solution

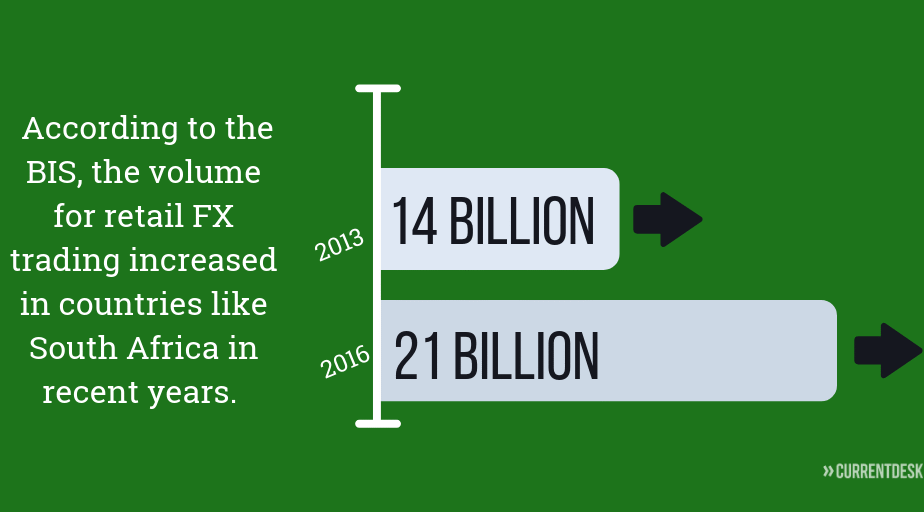

If you’ve been successfully trading Forex or working as an introducing broker for some time, starting your own Forex trading business may be the logical next step. Forex brokers can be highly profitable, and if you already understand the market and have industry connections, you are starting from a strong position.

That said, launching a Forex broker involves much more than trading knowledge. Technology, regulation, payments, liquidity, and client management all play a critical role. The way you structure these components from the beginning can determine whether your business scales efficiently or becomes locked into costly limitations.

Most guides present two options: building a Forex broker from scratch or purchasing a turnkey Forex broker package. While both approaches are possible, there is a third option that many experienced professionals consider the most practical and sustainable — using a stand-alone, non-turnkey system made up of independent services, often referred to as a custom Forex broker solution.

Understanding the Three Common Approaches

Building Everything Yourself

Building a Forex broker from scratch typically means developing or commissioning proprietary systems, sourcing infrastructure, and managing integrations internally. This may include custom trading software, client portals, compliance tools, and back office systems.

While this approach offers full control, it also introduces significant challenges:

High upfront development costs

Long implementation timelines

Ongoing technical maintenance

Dependence on internal or outsourced developers

For most new Forex brokers, this level of technical responsibility is unnecessary and risky.

Buying a Turnkey Forex Broker

Turnkey Forex broker packages bundle most or all required services under one provider. This usually includes a trading platform, liquidity, payments, CRM, and back office software.

Although turnkey solutions reduce setup time, they come with notable drawbacks:

Limited customization

Vendor lock-in

Higher spreads and fees

Little ability to differentiate your brand

Because many brokers use the same turnkey provider, their offerings often look and feel identical.

Using a Stand-Alone Custom Forex Broker Solution

A custom Forex broker solution does not involve building technology yourself, nor does it rely on a single turnkey vendor. Instead, it uses stand-alone, proven systems from specialized providers, each focused on a specific function.

In this model:

Trading platforms, liquidity, payments, CRM, and back office systems are sourced independently

All systems are off-the-shelf and designed to integrate

Each component can be replaced or upgraded without affecting the entire operation

This is how many established Forex brokers operate. It offers flexibility without the technical burden of in-house development and avoids the limitations of turnkey packages.

Why a Stand-Alone Custom Forex Broker Solution Is the Best Choice

A stand-alone custom Forex broker solution provides the balance most new brokers are looking for: professional infrastructure without unnecessary complexity.

Key advantages include:

No software development required

You are using existing, industry-tested platforms and tools.Freedom of choice

Each provider is selected based on performance and pricing, not convenience.Reduced dependency

No single company controls your entire Forex broker operation.Scalability

As your business grows, you can replace individual services without rebuilding your system.

This approach allows you to focus on compliance, marketing, and client acquisition — not technology management.

The 10 Essential Components of a Forex Broker

Every Forex broker needs the following tools to operate efficiently. A custom Forex broker solution allows you to source each one independently while ensuring seamless integration.

1. Business Plan With a Target Market

A detailed business plan is essential for any Forex broker. It helps guide strategic decisions and is often required by banks, payment processors, and regulatory bodies.

Your plan should include:

Startup and ongoing costs

Revenue model and spreads

Trade execution structure

Target market and geography

Competitive analysis and risk assessment

Defining your target market early makes it easier to choose the right technology and service providers.

2. Legal Structure and Regulatory Requirements

Before operating, you must establish a legal business entity. Requirements vary depending on where your Forex broker is incorporated and where you market your services.

Some brokers choose highly regulated jurisdictions, while others operate in less-regulated environments to reduce costs and speed up launch. Regardless of location, working with a law firm experienced in Forex regulation is strongly recommended.

They can assist with:

Company formation

Licensing requirements

Compliance documentation

3. Website and Branding

Your website is your primary marketing and trust-building tool. Most Forex traders will evaluate your broker based on your online presence.

Turnkey solutions often use reused templates, making many brokers look identical. A custom website allows you to:

Communicate your value proposition clearly

Build credibility

Differentiate your brand

If you plan to target multiple regions, multilingual support should be considered from the start.

4. Bank Account

Opening a bank account is one of the more challenging steps for a Forex broker. Many banks are cautious about working with Forex businesses, particularly unlicensed ones.

You may need to approach multiple banks or work with service providers that already have banking relationships. In some cases, liquidity or platform providers can assist with introductions.

5. Liquidity Provider

Your liquidity provider directly impacts spreads, execution speed, and overall trading conditions.

Retail Forex liquidity providers typically aggregate prices from:

Global banks

Financial institutions

Market makers

By selecting a liquidity provider independently, a custom Forex broker solution allows you to offer more competitive spreads than those often bundled into turnkey packages.

6. Payment Processor

To accept deposits and process withdrawals efficiently, you need reliable payment processors.

When evaluating providers, consider:

Transaction fees

Supported payment methods

Geographic coverage

Reputation and stability

Many Forex brokers work with multiple payment processors to improve reliability and client experience.

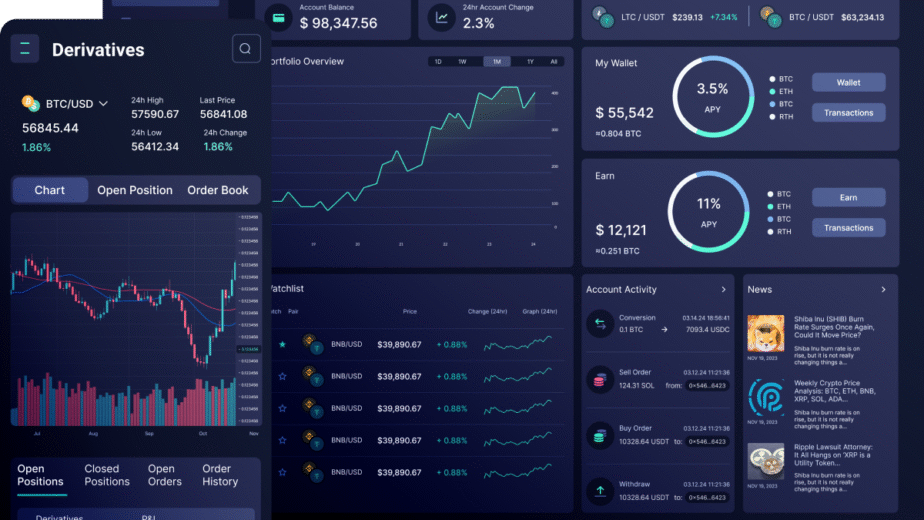

7. White Label or MT5 Platform

Most new Forex brokers use a white label trading platform rather than purchasing a full license.

Since MetaTrader no longer issues new MT4 licenses, MT4 access is only available through white label providers. MT5 white labels are also widely used due to lower costs and modern features.

Make sure your white label platform supports:

Full branding customization

Integration with your liquidity provider

Compatibility with your client portal

8. Client Portal

The client portal (also called a trader’s room or client cabinet) is where traders manage accounts, upload KYC documents, and communicate with your team.

A strong client portal should:

Be secure and easy to use

Support multiple languages

Integrate with your trading platform and CRM

Client portals are often part of a broader stand-alone system that includes CRM and back office tools.

9. Back Office Software

Back office software supports the operational side of your Forex broker. It typically includes:

Revenue and fee calculations

Compliance tools

Partner and IB management

Reporting and analytics

This software should simplify daily operations and give you clear insight into performance.

10. CRM

A CRM helps manage leads, clients, and communication. It plays a key role in sales, retention, and customer support.

When choosing a CRM:

Avoid tools owned by competing brokers

Ensure full ownership of your data

Look for strong automation and reporting features

In a custom Forex broker solution, the CRM operates as a stand-alone system that integrates with your other tools without locking you in.

Final Thoughts

Starting a Forex broker may feel complex, but it becomes manageable when approached with the right structure. We at CurrentDesk believe that rather than building technology yourself or relying on a restrictive turnkey package, a stand-alone custom Forex broker solution offers a more balanced and professional path.

By using independent, proven systems that integrate seamlessly, you reduce risk, control costs, and retain flexibility as your business grows. This approach mirrors how successful Forex brokers operate and provides a strong foundation for long-term success.