How to Choose the Best Forex Back Office for your Broker

What is a Forex Back Office System?

A forex back office is the department that manages all the operations of your brokerage as opposed to the front office which deal directly with clients. Front office includes sales and support and typically work primarily with a CRM. Back office manage treasury, revenue and profitability, rebates for partners, compliance and KYC and marketing.

A forex back office system, is a system that automates or facilitates the operations of the back office. In doing so, it allows you the brokerage to grow without increasing the number of back office employees in your organizations. Understanding how the to choose the best forex back office system in crucial for longer term operations.

In this article we explain what in our opinion you should look for when evaluating the best forex back office for your business. Any system you used should incorporate both back office and CRM. To find out what you should look for in the best forex CRM system please read here

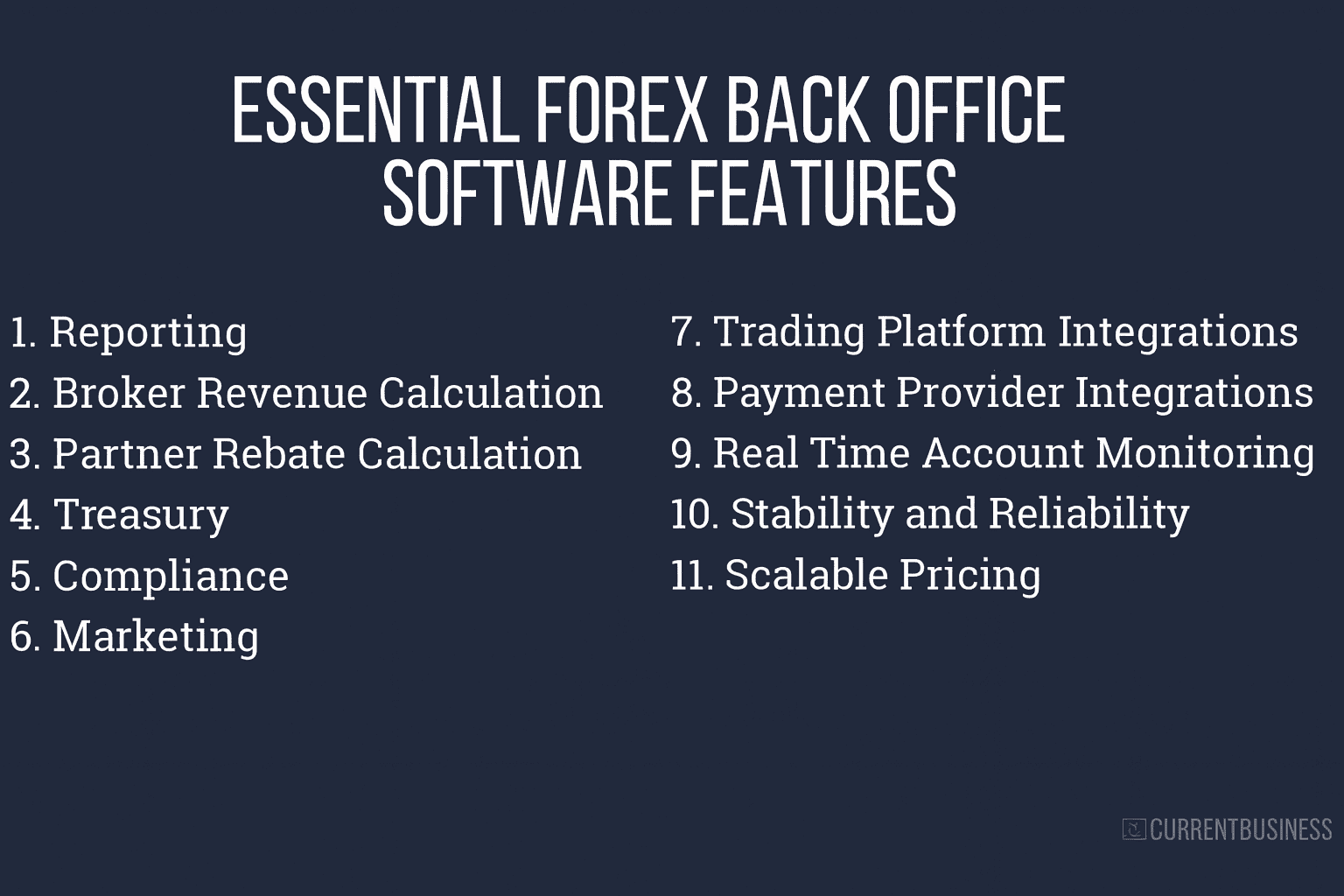

11 Key Points when choosing the Best Forex Back Office

Choosing the Best Forex Back Office impacts your operational efficiency significantly.

1. Reporting

With all the data that will go into your back office be it from the trading platform, client information, compliance processes, your team will need comprehensive reporting to do their job efficiently. It should be simple to generate reports on trading statistics, leads, revenue, dividends, transactions, KYC and much more.

2. Broker Revenue Calculation

With hundreds of thousands of trades going through your system you do not want to calculate your revenue and earnings with excel sheets. Therefore it is vital that the back office system keep track of revenue for you so that at the end of a period you can simply run a report and see how much your brokerage earned.

3. Partner Rebates Calculation and Allocation

You need to be able to pay rebates to your introducing brokers and any other partners. If multiple partners are associated with the same clients, then you’ll need a tool that allows you to easily manage multi level rebates or payments so that the appropriate person is paid the correct amount. For that, look for a forex back office software that specifically mentions multi-level rebate management.

4. Treasury

The treasury department manages and reconciles cash movements within your brokerage as well as deposits and withdrawals. This can be no small task and an error can cost a lot of money. You want to have a tool that makes this easy.

Such a tool should provide warnings, and prevent withdrawals and transfers out of trading accounts if certain conditions are met. Treasury reports should be detailed enough to facilitate reconciliation.

5. Compliance

Technology that helps financial services companies address regulatory challenges, often called RegTech, should be built in to a good forex back office. Look for software that allows you to manage KYCs and track whether or not clients have submitted the appropriate documents. Such a back office system should track when documents will expire and send emails to notify clients to update their documents. If you want to have very fast on-boarding consider forex back office that are integrated with an Auto KYC provider. Compliance is simplified by investing in the Best Forex Back Office solution tailored for your needs.

6. Marketing

Forex Back office software should include marketing tools that you and your IBs can both use. With the data from your reports, you should be able to see which clients are actively making trades and which ones have reduced their trading activity. The software should then allow you to create groups of clients to target with emails so you can direct marketing activity to the right clients. It should also allow you to create exclusive promotion links that you or your partners can share so that you can track the source of new leads.

7. Trading Platform Integrations

Forex brokerage back office software can work independently of the trading platform your firm uses. However, your brokerage’s operations will be much more smooth if the back office software integrates with MT4, MT5, Shift Crypto Exchange, Zulu Trade or the platform of your choice.

Your back office software should let you create trading account groups that connect to the trading platform. This connection will enable you to establish fees, commissions, and rebates within your software so that reports and payments are more accurate.

8. Payment Provider Integrations

One of the most significant barriers to clients depositing money is a complicated or lengthy process for funding their accounts. Connecting your back office software to external payment systems (like credit card processors, crypto-currency wallets, and bank transfers) reduces the length of time it takes for deposits to be credited to client accounts. Look for a tool that can integrate with Skrill, Nuvei, or Praxis.

We also recommend that the back office has a secure flexible API available so that you can integrate into it any payment provider of your choice without being dependent on the back office solution provider

9. Real-time Account Monitoring

If your back office software integrates with your forex trading platform, you can have real-time monitoring of all accounts. You’ll be able to view real-time margin, P/L, and position sizes for all client orders. This information will ensure you can issue margin calls at the appropriate times and advise your clients of their risks. It will also allow your firm to control its exposure, which might be especially useful if part of your firm operates as a dealing desk brokerage.

10. Stability and Reliability

With all the bells and whistles often stability and reliability are assumed but not verified. Features are useless to you if they dont work properly and worse if the system or pages crash occasionally. This should never happen!

Make use you get your forex back office system from a software company that specializes in this solution not a company that offers turn key products and for which the back office is just a “give away” because they earn their revenue from a trading platform or liquidity for example.

11. Scalable Pricing

Be careful not to get locked into a solution that has an inflexible set price as this will burden your brokerage if you are starting off a new company and it might burden you in the future if you have a weak period.

While there will typically be some small minimum to cover support and resource costs be sure that what your system costs you depends on revenue potential. This practice is already common for trading platform where there is a monthly minimum and volume fee.

With a back office system we recommend that a good pricing model will take into account the number of your active clients, which are clients who trade and make deposits. The Price shouldnt be volume dependent or dependent on the amount of deposits that you bring in, but rather a small flat fee per active client.

Such a pricing model guarantees that on weak months you will pay less.

Understanding scalable pricing is essential when evaluating the best forex back office tools.for your business

In Conclusion

New back office software requires two kinds of investments: money to license the software and time to implement it. Before making those investments, make sure the software you’re purchasing is worth it.

To do that, consider where you want your firm to be in a few years. You may not have partners now, but if you want your firm to grow then the software you choose should include features for managing IBs. Similarly, you may not plan to seek regulatory licensing immediately, but doing so in the future could help you expand your business.

Licensing the right back office software helps future proof your brokerage. We at CurrentDesk were the first globally to provide such a solution and as such we are sure that our solution is the most stable, reliable on the market and is the best forex back office system for any serious enterprise, big or small, so contact us if you’d like to learn more.

Future-proof your brokerage by selecting the Best Forex Back Office software for growth.