Forex Back Office for Brokers

Optimize your Operations with our Industry-Leading Forex Broker Management Software

Complete forex

Back office suite for your brokerage

Quickly see how much

Your brokerage is making in revenue.

Make regulatory

Compliance easier

Simplify transaction

Reconciliation and treasury workflows

Our primary back office features

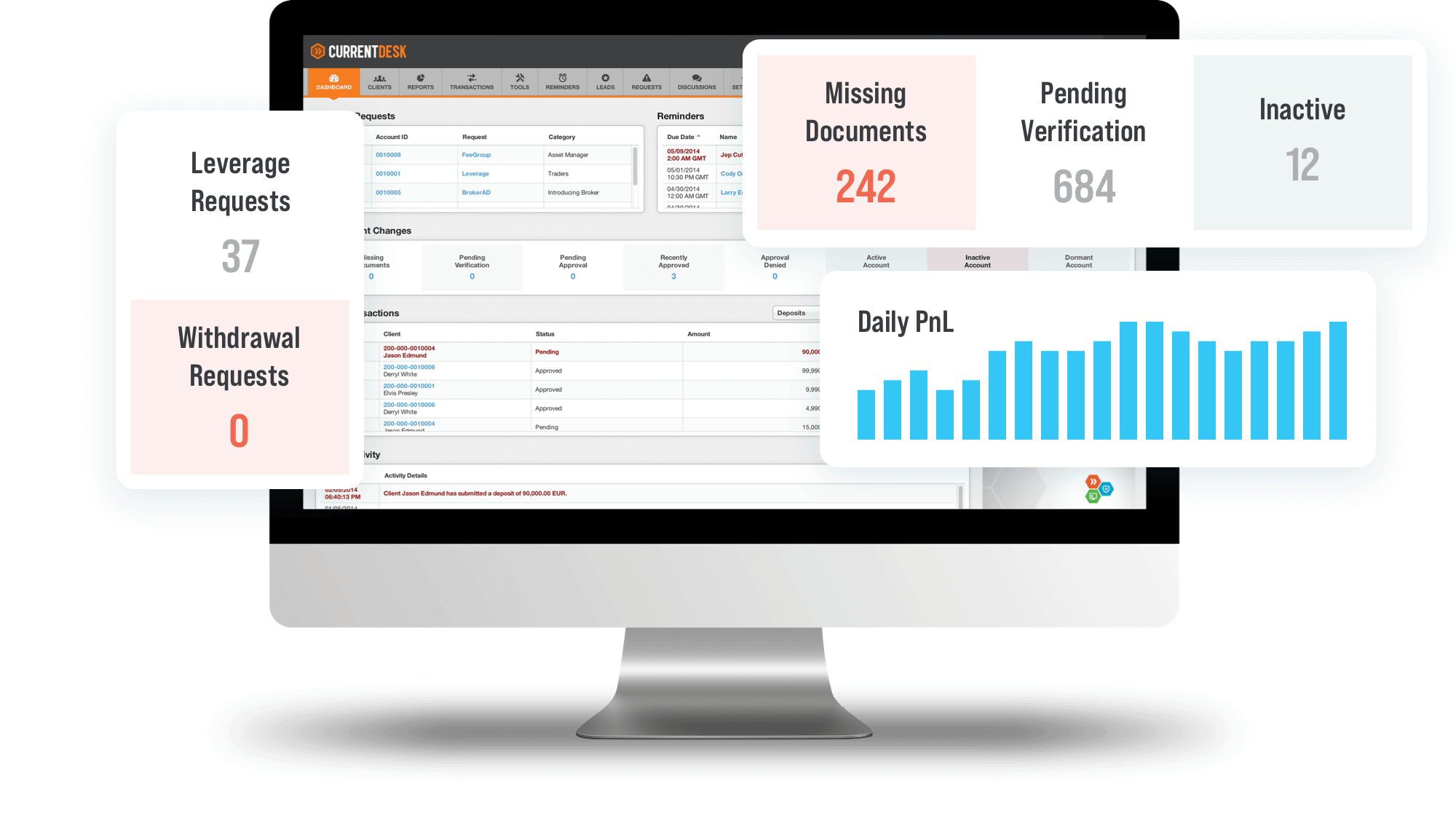

All-in-One Forex Broker Back Office and CRM Built for your Success

All-in-One Broker Management

CurrentDesk brings together compliance, treasury, sales, customer support, KYC, user roles, agreements, reminders, client requests, and reporting within a single, unified platform. The CurrentDesk Forex back office connects via API to MetaTrader 4, MetaTrader 5, Shift Crypto Exchange and more, payment providers, exchange rate sources, automated KYC services, click-to-call systems, and much more—enabling all your employees to operate within one efficient and fully integrated environment.

Purpose-Built Forex CRM

Ditch spreadsheets and generic CRMs and move to a purpose-built Forex back office platform that is already integrated with the leading tools in the FX industry. This ensures that all of your data is structured, meaningful, and actively contributes to your daily operations. CurrentDesk was designed specifically for Forex brokers, giving you a streamlined, powerful system to manage your brokerage’s client relationship management activities with greater efficiency and ease.

Automated Revenue Tracking

See exactly how much revenue you have generated over the past 24 hours—or any custom time period—through real-time reporting from all connected trade platforms. The CurrentDesk Forex back office automatically calculates revenue from spreads, commissions, transaction fees, and swap charges, eliminating the need for manual calculations and saving your team valuable time every day.

Out-of-the-Box Reporting

Access ready-made reports for commissions, spread markups, transaction fees, conversions, and dealing desk performance. At the click of a button your can see the status of you on-boarded clients, as well as your client’s and leads trading preferences so that you can better market to them. You can see each marketing campaign success, in terms of the leads, clients and revenue it generated.

Data Export & Analysis

Access a wide range of ready-made reports covering commissions, spread markups, transaction fees, currency conversions, and dealing desk performance. With just a few clicks, you can view the status of your on-boarded clients, along with your clients’ and leads’ trading preferences, enabling more accurate and effective marketing. You can also track the performance of each marketing campaign, including the number of leads generated, client conversions, and the revenue it produced.

Streamlined KYC Management

Simplify client verification and account onboarding with easy document uploads, automated reminders, and real‑time tracking of approval status within the CurrentDesk Forex back office. For even faster onboarding, you can enable our Auto KYC integration to verify and approve clients in minutes — reducing manual workload and speeding up the signup process while keeping compliance intact.

Simplified Compliance

Prove compliance effortlessly with built-in workflows—no need to chase administrators or clients for updates.

Transaction Tracking Dashboard

The Transaction Dashboard provides complete visibility into all cash flows — incoming deposits, outgoing withdrawals, and internal transfers within your brokerage. With real-time tracking and intuitive summaries, your team can quickly identify trends, monitor liquidity, reconcile accounts, and ensure operational efficiency. This level of transparency helps brokers make informed decisions, prevent errors, and maintain full control over their daily financial operations.

Mult-Partner Rebate Allocation Module

Manage commissions, and configure unlimited multi-tier IB partnerships to grow your network efficiently. Completely platform agnostic and as such compatible with a any integrated trading platforms, be it MetaTrader 4, MetaTrader 5, ShiftTrader, etc.

Bonus Module

Drive client on-boarding and referrals with our advanced bonus module. Bonuses are automatically allocated and can be converted into trading balance if desired, helping to boost trading activity. The system also includes safeguards against excessive losses and abusive behavior, such as moving funds between accounts to exploit bonuses.

Payment Provider Integrations

Integrated Payment Providers and Gateways given you access to over 600 payment providers. Accept global payments with ease. Major PSPs are pre-integrated, enabling traders to deposit funds using their preferred methods directly through the client portal. In addition, the CurrentDesk Forex back office supports flexible API connections to additional PSPs, giving you the ability to add regional or specialized payment providers.

Social Trading

Generate more volume with our integration to social trading services. Your clients can have multiple accounts all under the same profile, some to trade independently, others to be managed by a mam and yet others for social trading.

Auto Dividends Payouts

Pay clients dividends easily on long positions and charge them for short positions with CurrentDesk’s one of kind dividend payout module.

Our innovative services

Building and crafting your digital future

Time saving efficiency

Creating thousands of client accounts in any platform is lightning fast. System integrations enable your team to approve trader requests with one click.

Easier compliance

Secure KYC/AML document storage and reporting means your team can quickly find the right documentation to prove compliance without headaches.

Complete control

Enforce strict permissions control across all your users so you can have the peace of mind that only those you allow can perform certain actions.

Optimize your brokerage business today

Forex Back Office FAQ

Below — we answer the most common questions brokers ask about the CurrentDesk Forex back office: from security and scalability to integrations, compliance, and real-world onboarding timelines. If your question isn’t covered here — or you’d like more detail — feel free to contact us directly.

- Q: Does CurrentDesk have a client portal?

A: Yes, the CurrentDesk FX back office system includes a powerful, user-friendly client portal. The interface is designed to closely resemble modern online banking platforms, making it familiar and intuitive for users. Through this portal, clients can efficiently manage their funds, view balances and transaction history, run detailed reports, upload and manage KYC documents, submit support requests, and monitor trading activity. The client portal enhances transparency, improves user engagement, and dramatically reduces the operational workload for your internal support team.

- Q: Does CurrentDesk have a partner portal?

A: Yes, the CurrentDesk Forex broker back office system also offers a comprehensive partner portal. This dedicated space functions as a mini CRM specifically for Introducing Brokers (IBs) and Asset Managers (AMs). Partners can monitor their referrals in real time, track commissions and rebates, access marketing materials, communicate with clients, and manage performance metrics. This suite empowers partners to efficiently grow their business while strengthening your brokerage’s partner network.

- Q: What types of Partner (IB or AM) programs does CurrentDesk offer?

A: The CurrentDesk FX back office supports three distinct partner models to accommodate different business strategies. You can configure rebates based on trading account groupings, allocate commissions between multiple partners from a single trading account, or build advanced multi-level hierarchies using a rebate allocation tree. This flexibility allows you to create tailored, scalable partner programs that align with your business structure.

- Q: Does CurrentDesk provide a MAM or a PAMM?

A: Yes, the CurrentDesk broker management suit includes a built-in, industry-leading MAM solution for MT4, providing highly precise allocation down to the cent. For MT5 environments, external providers such as Goldi can be integrated to extend functionality.

- Q: Can you integrate additional products?

A: Absolutely. All integration requests with the CurrentDesk Forex broker back office undergo a technical and security review to ensure compliance with industry standards. Once approved, seamless integration is performed to maintain system reliability and data security.

- Q: Do you support white labeling for multiple brands?

A: Yes, the CurrentDesk broker back office fully supports white labeling. This allows brokers managing multiple brands to maintain consistent infrastructure while customizing the front-end identity for each brand.

- Q: Does your system include a loyalty or bonus program?

A: Yes, the CurrentDesk broker back office features an advanced bonus and loyalty module. This enables brokers to reward clients for fast onboarding, funding their accounts, trading volume, and referrals, creating stronger engagement and retention.

- Q: Is CurrentDesk integrated with payment providers (PSPs) or payment gateways?

A: Yes, the CurrentDesk Forex back office integrates directly with multiple PSPs and a payment gateway, giving access to hundreds of providers globally. In addition, it offers a secure, flexible API that allows you to integrate with any preferred PSP upon request.

- Q: Does CurrentDesk have a compliance tool?

A: Yes, compliance is core to the CurrentDesk FX back office. It includes a built-in KYC tool for document verification and compliance tracking. For advanced automated onboarding, the platform integrates with SumSub, enabling client verification in minutes.

- Q: Is the CurrentDesk Forex back office separate from the CRM?

A: No, the CurrentDesk solution is a fully unified system. The Forex back office, Forex CRM, client portal, and partner portal are all included in one cohesive, cost-effective platform. It is suitable for brokers of all sizes, from startups to established industry leaders.

- Q: What types of reports are included in the CurrentDesk Forex broker management suit?

A: The CurrentDesk Forex back office provides access to more than 25 advanced reports, including end-of-day summaries, rebate and bonus reports, account statements, compliance monitoring, and detailed sales and marketing analytics. These reports give you valuable business intelligence to support strategic decisions.

- Q: Does CurrentDesk offer system customization?

A: Yes, customization is available within the CurrentDesk FX back office. Frequently requested enhancements may be delivered at no additional cost if they benefit multiple clients. Highly specialized or unique modifications may involve an additional development fee.

- Q: Can the Forex back office support multiple regions and languages?

A: Yes, the CurrentDesk Forex back office is built to support multi-language and multi-region operations. This feature is particularly valuable for brokers working with international clients, as it enables localized experiences, regional compliance flexibility, and customized onboarding processes to match the requirements of different jurisdictions.

- Q: How does a Forex back office improve operational efficiency?

A: A modern Forex back office centralizes all operational tasks such as client onboarding, compliance, payment management, partner tracking, and reporting. By automating these functions, CurrentDesk significantly reduces the need for manual work, lowers the risk of errors, and improves response time for both internal teams and clients.

- Q: Is the CurrentDesk Forex back office suitable for startup brokers?

A: Yes, the CurrentDesk Forex back office is specifically designed to support both new and established brokers. For startups, it provides all essential tools—from CRM and client management to compliance, reporting, and payment integrations—within a single platform. This significantly lowers operational and technical barriers, allowing new brokers to launch quickly, scale efficiently, and remain fully compliant from day one.

- Q: How long does it take to deploy CurrentDesk for a new broker?

A: For a new brokerage that does not require legacy data migration, CurrentDesk can often be deployed and operational within one business day, provided that the necessary setup information is delivered promptly. This rapid “go-live” timeframe includes account initialization, basic configuration, and access provisioning — ideal for start-ups eager to launch quickly.

If your setup requires migration of existing client, trade, or historic data, the timeline typically extends by 1–2 additional days, depending on data volume and format. In such cases we provide clear guidelines on data formatting and assist with migration to ensure seamless integration into the Forex back office.

- Q: What kind of reporting and analytics are available in the Forex broker management suit?

A: The reporting module in CurrentDesk offers over 25 built-in reports — but that’s just the beginning. Reports cover:

End-of-day summaries and P&L calculations, so you immediately know how much your brokerage earned each day.

Partner rebate and commission reports — detailing which IBs or AMs generated commissions, their respective shares, and pending payments.

Client account statements, deposit/withdrawal logs, and compliance-related reports (e.g., KYC status, document expiration).

Marketing & sales analytics: you can track client acquisition, activity patterns, and deposit trends to support data-driven growth decisions.

Export tools: each report can be exported to Excel or CSV, enabling deeper external analysis, custom dashboards, or integration with your internal BI systems.

These reporting capabilities make the Forex back office not just an operations tool — but a full business intelligence hub for your brokerage.

- Q: How flexible is CurrentDesk when it comes to compliance and regulatory requirements?

A: Very flexible. The CurrentDesk FX back office includes built-in workflows for KYC, AML, documentation management, and regulatory compliance tracking. For more advanced needs, we support integration with third-party compliance platforms (e.g., automated identity verification, regulatory document validation), giving you the ability to scale and adapt as your business and regulatory environment evolves.

Additionally, the system supports role-based permissions and audit trails — so every action (document upload, approval, compliance check) is logged. This helps brokers maintain transparent records, prove compliance to regulators, and manage internal oversight efficiently.

- Q: Can CurrentDesk support multiple office locations, global clients, and multi-currency operations?

A: Yes. The CurrentDesk FX back office is designed to handle international brokerages. The platform supports:

Multi-region operations: manage clients from various jurisdictions, each with their own compliance, KYC, and documentation requirements.

Multi-currency accounts and conversions: clients can deposit, trade, and withdraw in different currencies; the system handles reconciliation, conversions, and reporting accordingly.

Multi-language support (upon request): the user interface for clients or partners can be localized to match regional languages — improving client experience and compliance with local regulations.

This makes CurrentDesk suitable for brokers targeting global markets or operating across multiple jurisdictions.

- Q: What kinds of payment methods and local payment options are supported?

A: CurrentDesk already integrates with hundreds of Payment Service Providers (PSPs) and includes a flexible, secure API — which means you (or your clients) can use a wide variety of deposit and withdrawal methods. These typically include: bank transfers, e-wallets, local payment options (depending on region), and credit/debit cards (where compliant).

If you have a preferred payment provider that is not already integrated, we can review and — subject to technical and security evaluation — add it to the system. This ensures that you can cater to local payment preferences of your clients, which is especially important for global and regionally diverse brokerages.

- Q: What is the support model at CurrentDesk? How do you handle issues or onboarding assistance?

A: CurrentDesk offers 24/7 support for critical issues affecting your Forex back office operations — such as system downtime, payment failures, or security incidents. For general questions, training, onboarding help, and configuration guidance, we provide 24/5 support.

Beyond reactive support, we also offer onboarding assistance, documentation, and training to help your team or partners make full use of features like client and partner portals, reporting, compliance, and integrations. If you need a custom workflow or feature after onboarding, we accept customization requests to adapt the system to your brokerage’s evolving needs.

- Q: Can I link CurrentDesk to external tools — for example CRM, analytics, or marketing automation?

A: Yes — the CurrentDesk Forex back office is built with extensibility in mind. Through its secure API and modular architecture, you can integrate third-party systems such as: CRM tools, marketing automation platforms, external BI or analytics software, or other financial services tools.

Each integration request is subject to a technical and security review to ensure compatibility and protect data integrity. Once approved, integrations are implemented smoothly — allowing you to extend functionality without compromising system stability.

- Q: How does CurrentDesk handle data privacy and compliance with international regulations?

A: Data privacy is a core feature of the CurrentDesk FX back office. Because we are ISO 27001:2022 certified, we adhere to internationally recognized standards for information security management. This includes secure data storage, encrypted communication channels, access control, and periodic audits to maintain compliance.

When onboarding clients from different jurisdictions, CurrentDesk enables tailored compliance workflows to meet regional regulatory requirements (e.g., KYC, AML, documentation, regional tax or reporting rules). This makes it easier for global brokers to run a compliant operation without manually adapting processes for each region.