Tips for Fraud Risk Management

How to protect your business from financial fraud

Client risk analysis

The first step in preventing financial crimes against your business is learning to identify risky transactions and clients. There are several ways to determine whether a customer presents a larger risk.

For example, customers from specific regions may be more likely to commit fraud. Many risk analysis experts use the number of chargebacks in a country to estimate the worst regions for fraud. Chargebacks often indicate that many merchants or payment processors haven’t adopted fraud prevention tools.

Recent research indicates that countries with the highest frauds are Mexico, the Netherlands, France, and Russia. Blocking all charges from customers in these countries would prevent many legitimate sales, but you can use the knowledge of fraud rates in these countries to implement an additional screening for charges coming from an IP address in one of those countries.

Many customers also shop for services that are prohibited in their countries. Then, they file a chargeback for the service claiming that it’s an illegal one. Your services may be especially appealing to residents of countries where they’re illegal. Taking extra precautions when dealing with charges from those countries can help reduce fraudulent chargebacks.

Once you know what factors indicate a client might be high risk, train your employees how to recognize those risks as well.

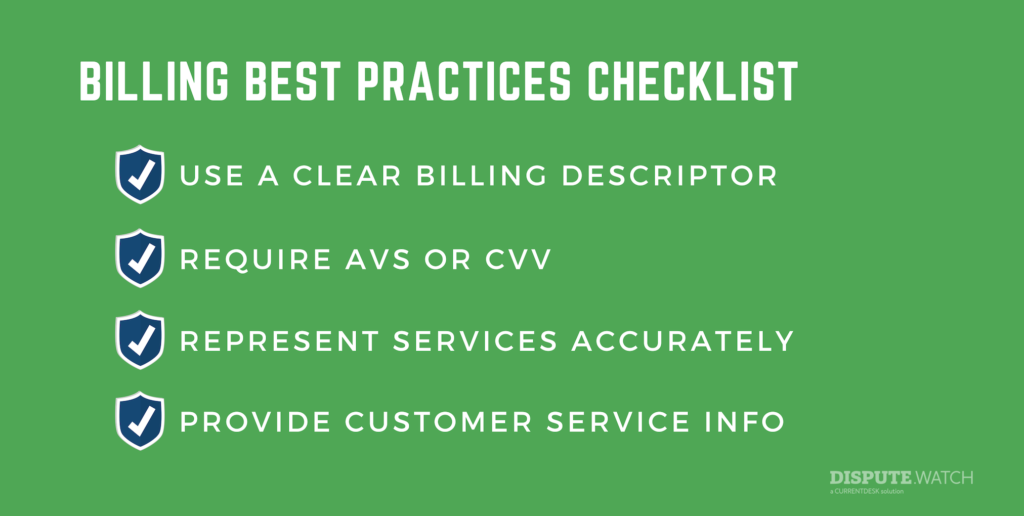

Follow best practices for payments and billing

One of the simplest chargeback prevention methods is to follow best practices when accepting online payments.

- Have a clear billing descriptor: A billing descriptor is the company name that will appear on your customer’s credit card or bank statement. You set up a billing descriptor with payment providers. Your billing descriptor helps clients recognize charges and the businesses where they’ve made purchases. If a customer doesn’t recognize your billing descriptor, they’re more likely to file a chargeback. Choose a billing descriptor that is similar to the business name your client’s associate with you.

- Require extra information at checkout: Require customers to enter the CVV code on their credit or debit card and to input the address associated with the card. Using the Address Verification System (AVS) and collecting CVV numbers helps ensure that the person making the transaction owns the card. If someone can’t provide the correct billing address and security code, they’re likely using the card without authorization, which means you’ll be faced with paying for the cost of the services and paying a chargeback fee.

- Describe your services and policies accurately: If you advertise a higher return on an investment, guarantee success, or exaggerate a product’s abilities, customers will be able to file a chargeback claim successfully.

- Make it easy to contact customer support: Make sure customers can find a phone number or email address on your website so they can easily contact your customer service department. If a customer with a problem can easily contact you, they’re less likely to file a chargeback with their bank or credit card company. If they have a legitimate complaint or the card was used without their authorization, you can offer them a refund to avoid any fees or penalties associated with a chargeback.

To further ensure that you’re protected from fraud, only work with payment providers that also follow these practices.

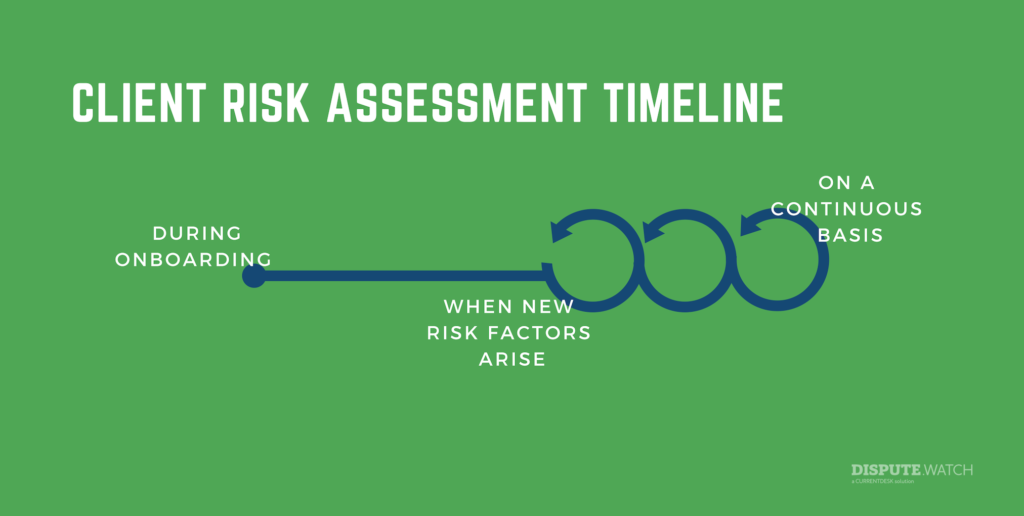

Assess risks early

To prevent friendly fraud and other types of client fraud, assess how risky a client may be during onboarding. One way to perform that kind of risk analysis is to use a fraud database, like DisputeWatch.

Shared fraud databases allow many different companies to enter information about fraudulent transactions and clients into a database. Then, each company can search the database whenever they onboard a new client. If the client’s information matches information in the fraud database, the company can decide how to proceed.

Unlike a blacklist, which automatically blocks transactions for certain accounts or IP addresses, a shared fraud database lets you or your employees decide whether or not a client is too risky. If you simply use a blacklist, you could lose business by blocking legitimate clients or transactions.

By checking for a history of chargebacks, bonus abuse, latency trading, or other fraudulent behavior during onboarding, you can put extra precautions or restrictions in place to prevent fraud before it happens.

Assess risk continuously

While many companies use some sort of risk analysis tool when they onboard clients, most of those companies don’t continuously monitor clients to make sure their risk level hasn’t changed. Ongoing and real-time monitoring is essential to reduce financial crimes against your business.

When you use a fraud database like DisputeWatch, you will receive email alerts any time a fraudulent transaction occurs with information connected to one of the people on your watchlist.

You can use that information to determine whether one of your existing clients has started to behave fraudulently. If so, you can add restrictions to their account or take other steps to prevent client fraud.

Conclusion

Risk management may seem like a complex and expensive investment. However, if you take a few simple steps to learn about risks, prevent problems with payments, and monitor your clients, then risk analysis will be well worth your time. Additionally, all of these are free.

You can join DisputeWatch for free to assess client risk during onboarding and continually monitor your clients for a change in behavior. Using best practices for payment processing and client monitoring will help prevent financial crimes from impacting your company’s profits.

Protect your brokerage from charge back fraud

Request your exclusive invite to the DisputeWatch network

Comments are closed.