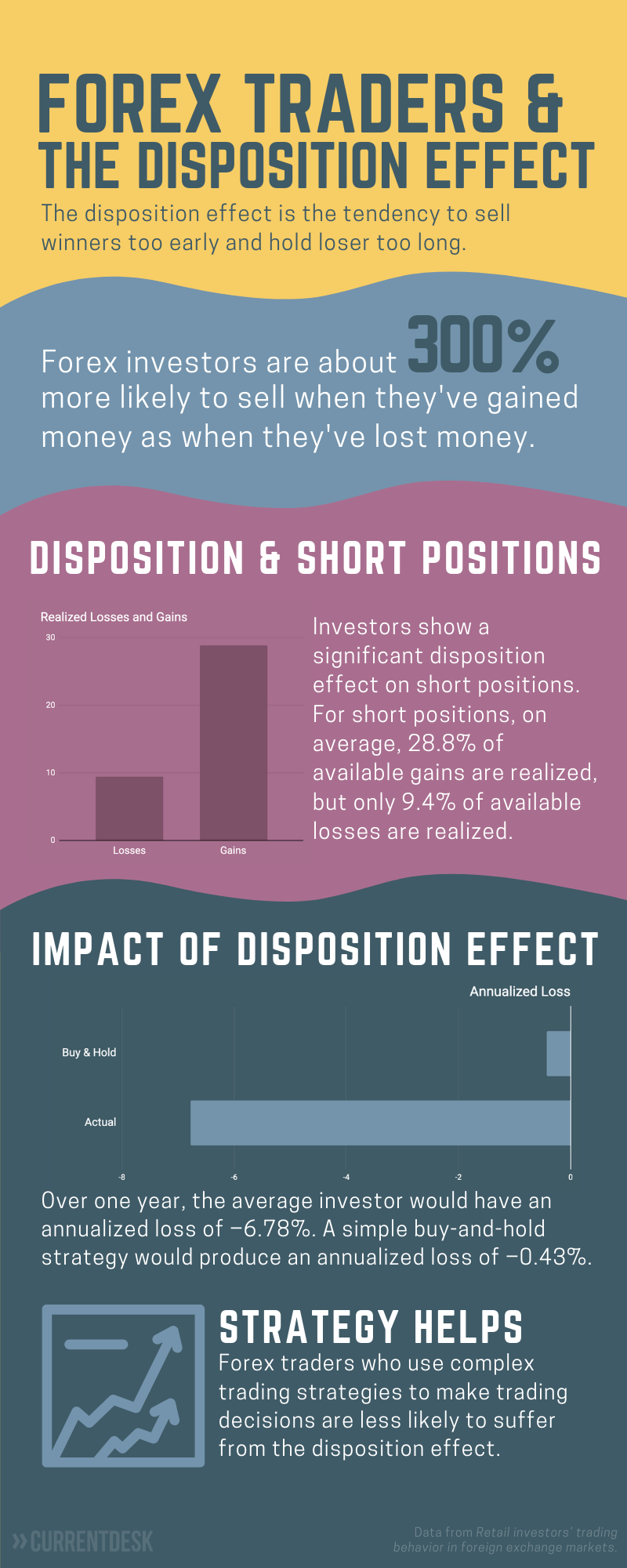

The Disposition Effect and Forex Traders

When forex traders realize losses and gains

We thoroughly believe that the better you understand your clients, the more your business will grow.

When you understand your clients, you’re better able to give them what they want. In previous posts, we’ve covered general statistics about retail forex traders, how wins and losses affect those traders, and reasons that they quit trading.

Today, we’re bringing you stats from Retail investors’ trading behavior in foreign exchange markets. This article uses trading data from Oanda for 14 currency pairs during the period of April 24, 2013 to June 1, 2018. Based on long and short positions and currency prices during this time, the authors make arguments about how much the average trader is susceptible to the disposition effect.

This report highlights one aspect of behavioral finance that impacts forex traders. The better you understand what impacts your clients’ activity, the better you’ll be able to offer what they need.

If traders lose money because of the disposition effect, and if they’re more likely to stop trading after they’ve lost money, then offering educational content about avoiding the disposition effect could help you keep traders longer.

The client portal for Forex brokers

Build better client experiences and boost retention

Comments are closed.