Managing Account Groups on MetaTrader

Understanding and using account groups with MetaTrader

MetaTrader allows you to organize all of your clients’ trading accounts into account groups.

For each account group, you set the leverage, margin call level, and stopout level for all trading accounts in that group as well as determine whether the accounts in the group can do swaps.

You also select which securities the accounts in the group can trade and set up the options for those securities, including the minimum position size, the step size for positions, the markups, taxes, and commissions on them.

Account groups, then, are a way for you to set up what clients can trade and how much they’ll be charged for their trades, on a per security basis. For example, you can use account groups to offer more favorable rates to clients who are very active or to limit non-professional traders to smaller trades and with lower leverage.

Account groups make it possible to have these settings for every trading account without needing to recreate them every time someone opens a new trading account.

What are the limits of account groups on MetaTrader?

MetaTrader 4 sets a limit of 512 account groups for every full license. If you use a white label provider for your license, you will likely have far fewer account groups available.

MetaTrader 5 does not limit the number of account groups for each license, but many white label providers limit them. For example, we’re familiar with some white label providers who limit brokers to just 9 account groups.

These limitations mean that you will only be able to have a few groups that you can place trading accounts in, which means only a few leverage, markup, and commission options.

Can you get more account groups on MetaTrader?

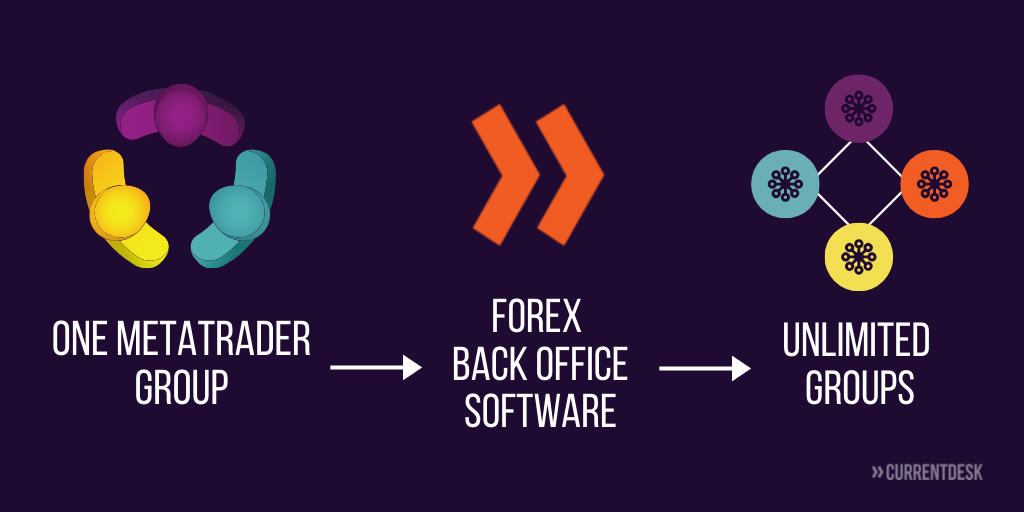

If you need an unlimited number of account groups, you can either purchase a full MT5 license or invest in back office software that integrates with MT4 or MT5 and expands the number of available groups.

Forex back office software can connect to MT4/5 with a manager API, and the software can have multiple account groups for a single account group in MetaTrader. For example, you could have Groups A, B, and C in your software all connected with Group 1 on your MetaTrader platform.

These groups will all need to have the same settings for some options around account groups. So, Groups A, B, and C in your software would all need to have the same markups as Group 1.

However you should be able to add additional settings within the software that would differentiate these groups.

Group A could be for introducing brokers that do a lot of volume in which you payout higher rebates while Group B is for introducing brokers with less volume receiving a smaller rebate, and Group C could be categorized as professional while A and B are for retail.

What else should account groups do?

In addition to giving you additional groups and settings, account groups that you set up within forex software should provide a few other benefits.

You should be able to associate each group with one of your introducing brokers or partners. This association allows you to automatically assign all of that partners’ new clients to that group and automatically pay that partner when one of their clients makes a trade.

The software should also be capable of producing reports with information about the group clients are a part of. You can use such reports to see a breakdown of activity by account groups.

Account groups are a powerful tool in MetaTrader. The right back office software can remove limitations and make them even more powerful. To learn how CurrentDesk can help you get more out of MetaTrader groups, contact us

Forex back office platform for brokers

Automate manual processes and level-up your broker operations

Comments are closed.