Choosing a Forex Trading Platform

Which forex platform is best for your brokerage?

MetaTrader 4 (MT4) is the monolith of forex trading platforms. Even the successor that MetaQuotes designed to replace MT4 hasn’t been able to replace it. Despite the fact the MetaQuotes stopped selling MT4 licenses or adding new features, MetaTrader 5 (MT5) still isn’t as popular as MT4.

MT4 is popular for a few reasons. MetaQuotes allowed MT4 license holders to white label and re-sell limited versions of MT4. This white label option made it easy for forex brokers to use the MetaTrader platform. They could obtain an MT4 white label for a few thousand dollars per month instead of purchasing their own license for $100,000. Because small brokerages could easily offer services with an MT4 white label, all the forex traders who used those brokerages became accustomed to it.

Regardless of MT4’s popularity, many other trading platforms exist. Because our forex CRM is platform-independent, we’ve heard some questions about the best forex trading platform. Ultimately, there isn’t one forex trading platform that’s best for all brokers. You need to consider your business needs. That said, there are a few pieces of advice we can offer.

MetaTrader 4/5

You’ve likely used MT4 at your brokerage (or are considering using it) because MT4 white labels are relatively inexpensive and most clients are familiar with the software. If MT4 meets all your needs, then you can likely continue using it without any problems. In that case, you simply need to find the best forex white label provider for your business.

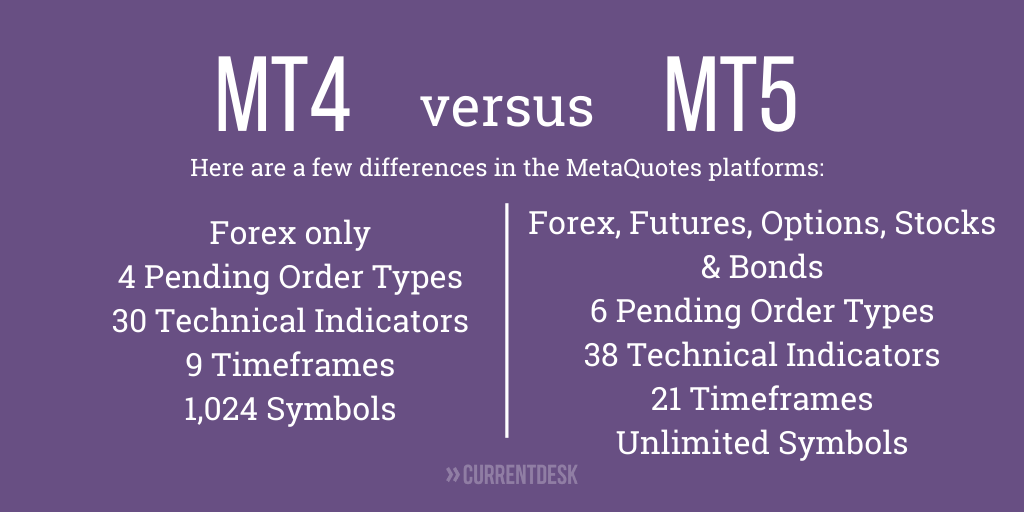

However, there are many benefits to switching to MT5 or at least adding it as an option for clients. MT5 allows for trading multiple assets, including forex, futures, options, stocks, and bonds. MT5 also has more order fill policies and pending order types than MT4. When you compare MT4 and MT5, you’ll see several other features that MT5 offers that are absent from MT4.

MT4 won’t get those features in the future since MetaQuotes has stopped upgrading it. Additionally, MetaQuotes also stopped selling full licenses to MT4, so you will have to continue to rely on a white label provider, even if your brokerage grows in the future.

Many white label providers offer third-party licenses for both MT4 and MT5. Not all brokerages need to offer both trading platforms, but doing so may help you appeal to a larger client base. MetaQuotes’ decision to stop updating MT4 means that regardless of its popularity, the platform can’t survive forever. If you’re opening an FX startup and want to offer a MetaTrader platform, MT5 is probably the way to go.

Choosing a white label provider

If you’re looking for an MT4 or MT5 white label provider, you have a lot of choices. Here are a few things to consider when making your choice:

Liquidity — Having the same liquidity and white label provider can simplify running your brokerage.

Reporting tools — Getting data from your white label software should be simple. It should include reports on P&L, risk, swaps, deposits, and withdrawals.

Risk — Look for a white label tool that includes risk management features to help protect your brokerage.

Cost — Don’t be fooled into thinking that the higher the cost of a white label, the better the service will be. White label providers can offer excellent service for reasonable prices.

In addition to its XW Trader platform, Forexware offers an excellent MT4/5 white label. It’s reporting, risk management, and liquidity options are among the best in the business.

MetaTrader Alternatives

There are a few reasons that your firm might want to use a different trading platform.

MetaQuotes has a large market share. That means they may be less likely to listen to the requests and problems that smaller brokers have. Lots of brokerages were unhappy with the way MetaQuotes abandoned updates to MT4 given its popularity. If you’re already planning to move away from MT4, there’s no reason not to look into leaving MetaQuaotes altogether.

Luckily, there are many MT4/5 alternatives.

XW Trader, made by Forexware, is an excellent alternative. The platform offers chart based trading with customizable indicators. It has an algorithm console that will allow traders to choose their own trading strategies and test those strategies. It can connect to social trading sites if your client base tends to be interested in that, but it also has managed account features so you can accommodate clients who want to invest in forex without making trading decisions.

Working with a company like Forexware creates an ideal situation for firms that want to offer clients multiple trading platforms and those may want to switch trading platforms in the future. Forexware sells MT4 and MT5 white labels as well as their proprietary FX platform. If you currently use an MT4 white label but want to add MT5 or a non-MetaTrader option, then you can partner with a single company and have access to multiple platforms.

The trading platform you choose determines what kind of financial instruments you can offer clients, whether you can offer social trading, and much more. In other words, it determines what kind of brokerage you’ll have. The company that provides the trading platform or a white label to one will be critical to your brokerage’s success.

Whether you choose MT4, MT5, or another forex platform, look for a platform provider that will help you build your customer base by giving you powerful and efficient FX trading solutions.

Need a Forex CRM?

Learn how CurrentBusiness can help you run a successful brokerage.

Comments are closed.