Back Office Forex Software and MiFID II Compliance: Part 2

Working with IBs

ESMA’s MiFID II requirements standardize investment rules throughout the European Union and help protect investors. However, they also create extra red tape for brokers.

ESMA’s MiFID II requirements standardize investment rules throughout the European Union and help protect investors. However, they also create extra red tape for brokers.

In last week’s blog, we covered how back office software can help your forex brokerage notify clients about risks and assess whether complex products are right for them.

Now, we’re looking at the ways software helps you document the work that introducing brokers (IBs) do for your firm. The most recent update to ESMA’s Questions and Answers: Relating to the provision of CFDs and other speculative products to retail investors under MiFID recognizes the widespread use of IBs at forex and CFD investment firms, which indicates regulatory authorities may pay closer attention to these relationships in the future.

The right software makes managing IBs and staying in line with ESMA rules much easier.

Control IBs activities

The ESMA Q & A update states that licensed firms must have “robust controls” in place to help them manage IBs’ activity.

The ESMA Q & A update states that licensed firms must have “robust controls” in place to help them manage IBs’ activity.

Good brokerage software makes it very simple to put those controls in place. Back office software designed specifically for brokerages should have the ability to create different types of roles for users and then give those roles the appropriate permissions.

For example, the software should have a role for all IBs. This role could have permission to approve transactions, request KYC documents, and see which leads have made deposits. It might not have the ability to approve KYC documents or approve new accounts. When all IBs are assigned to this role, they would have the correct permissions when they log in to your back office system.

This level of granular control allows IBs access all the necessary information to assist clients and attract leads without giving them unnecessary privileges. Having that control and using it also shows regulators that you closely monitor IBs’ activity.

Document connections and compensation

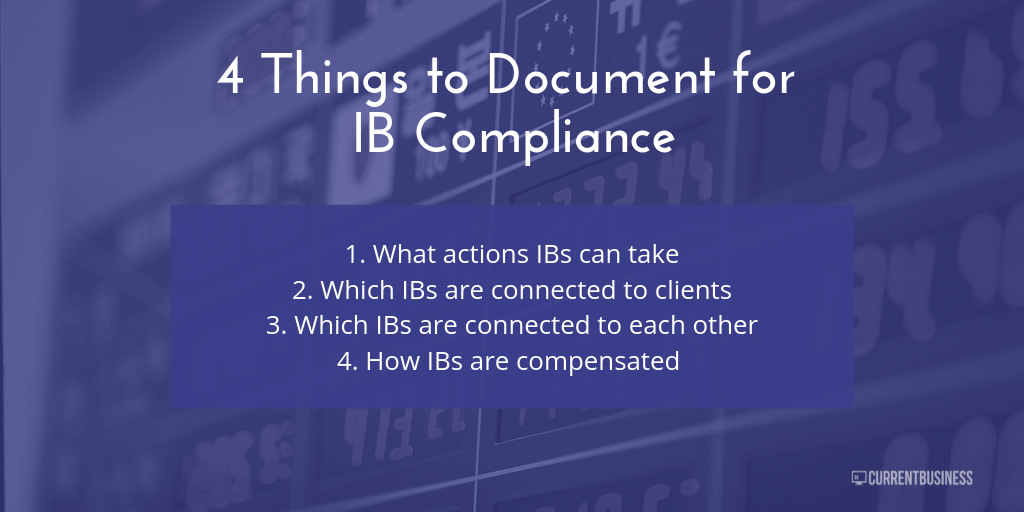

When using an IB or other third party to work with clients, you have to keep excellent records. You need clearly document which clients are associated with which IBs and whether any IBs are associated with one another. You also need to document how IBs are compensated for their work.

Forex brokerage software can make it easy to keep track of that information if it has tools for multi-level partnership management.

Use your software to quickly see all of an IB’s clients and their statuses. By having this information constantly available and up-to-date, you’ll be able to demonstrate to regulators that your firm could quickly identify any conflicts of interest or other problems that might harm investors.

You software should also allow you to set up fee management. This ability means you can easily control and document how you compensate IBs, a subject in which regulatory authorities will be especially interested.

Good back office forex software should also make it easy for you to quickly view and download all the revenue associated with an IB. These documents can further show that you monitor this revenue for anything inappropriate or suspicious.

Remember, ESMA regulations and those for specific EU member countries change regularly. It’s important to read stay informed on the regulations in your country and to consult an attorney about your obligations. Then, use good software to meet those obligations so you stay in compliance.

If you missed the first part of this series, check it out here, and if you’d like to know how CurrentBusiness helps brokerages with multi-level partnership management, contact us.

Forex CRM system for brokers

Convert more leads into traders

Comments are closed.