Back Office Forex Software and MiFID II Compliance: Part I

Client notifications and assessment of suitability

In its effort to integrate Europe’s financial markets, the European Securities and Markets Authority (ESMA) created MiFID and MiFID II. This regulatory framework sets standards to help protect consumers and ensure they’re informed about the investments they make.

In its effort to integrate Europe’s financial markets, the European Securities and Markets Authority (ESMA) created MiFID and MiFID II. This regulatory framework sets standards to help protect consumers and ensure they’re informed about the investments they make.

Meeting the MiFID II requirements presents many challenges for brokers, especially smaller firms with more limited resources. The right back office software can greatly help with those challenges.

In this two-part series, we’re highlighting specific ways that the right software helps with regulatory compliance in the forex industry.

Notifying clients about the risks of complex financial investments and assessing whether those products are suitable for clients is a key part of MiFID requirements. Back office software can help automate and document your efforts in relation to two of these requirements.

Notify clients about risks

ESMA stresses the importance of clients understanding the risks of speculative investments, like CFDs and forex, and it places the burden of informing clients about those risks on brokers.

ESMA stresses the importance of clients understanding the risks of speculative investments, like CFDs and forex, and it places the burden of informing clients about those risks on brokers.

Back office software can help you provide information about risk to clients and document that you’ve done so for licensing purposes.

ESMA’s Questions and Answers Relating to the provision of CFDs and other speculative products to retail investors under MiFID specifically mentions that many firms choose to provide risk information to clients on their websites.

You can add an extra layer of disclosure by sending information in emails. Providing details about the risks of speculative products in multiple ways helps show regulatory authorities that you take MiFID requirements seriously and that you want your clients to be well informed.

The right forex back office software can make it easy to send information in the text of an email or send a link to a downloadable file.

The software can retain the email in your system, so your firm will always have a record of all the mediums you used to notify clients about the risks associated with speculative investments.

Assess suitability

In addition to providing information to clients, brokers must also collect a great deal of information from clients, including whether speculative products are right for them and whether they understand the risks.

You could do this in a phone interview or a face-to-face meeting. However, given the online nature of the forex retail trading industry, it will likely be easier for you to do with with a questionnaire.

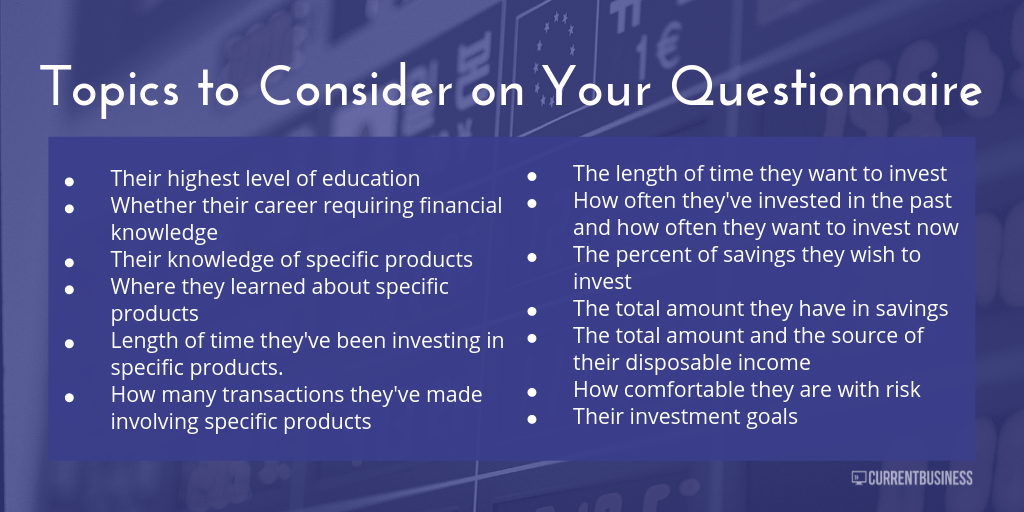

Your questionnaire should aim to determine how familiar the client is with the type of security they’re interested in and whether they’re capable of understanding the associated risk. It should also determine their investment goals and ability to bear financial risk.

You can create a form on your own website with all the questions from your suitability questionnaire. Then use your software’s API to easily import leads’ answer into your records. Storing answers to your questionnaire will show regulators you collect and record data related to suitability.

You may allow clients to invest in CFDs or forex even if your firm does not believe the product is suitable for them. However, if you choose to do this, you should require the client to sign an acknowledgement stating that you’ve deemed the product inappropriate for them and they want to invest anyway. Your back office software should allow you to set up agreement and disclosure forms that make it simple for you to provide such a document to a client and for them to sign and return it to you.

Choice of software

ESMA recognizes that many brokers use software and other third-party technologies in their day-to-day operations. It also recognizes technology providers may not have a client’s best interest at heart even if your firm does, your choice of service providers can impact your ability to be licensed.

ESMA’s Q & A on speculative products specifies that third-party providers should not financially benefit from the trading revenue a firm generates or the profit/loss ratio of the firm’s clients. Make sure to choose a software provider that has some sort of fixed fee structure that doesn’t incentivize them to create a product that would be disadvantageous to your clients.

Choosing a software tool is essential for your firm’s efficiency and its ability to be licensed in your jurisdiction. To see if CurrentBusiness is the right software for your forex firm, contact us.

Read Part 2 of these series now.

Note: It’s always best to consult the most recent publications from your regulating authority and speak with your attorney when making decisions about regulations.

Forex CRM system for brokers

Convert more leads into traders

Comments are closed.